Loading

Get Irs 8862 (sp) 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8862 (SP) online

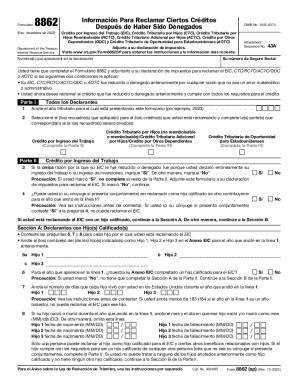

Filling out the IRS 8862 (SP) form online can be a straightforward process if you follow the right steps. This guide will provide you with clear instructions to help you successfully complete the form and claim the credits you are eligible for.

Follow the steps to efficiently complete your form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate the tax year for which you are filing this form in the provided field.

- Select the applicable boxes for the credits you are claiming and complete the corresponding sections.

- If you are claiming the Earned Income Credit (EIC), complete Part II. Respond to the questions regarding income discrepancies and whether you or your spouse can be claimed as a qualifying child.

- If you have qualifying children, provide their names and the number of days they lived with you during the tax year.

- If you are claiming the Child Tax Credit, fill out Part III, listing your qualifying children and dependents.

- For the American Opportunity Tax Credit, complete Part IV with the necessary student information.

- If applicable, fill out Part V regarding any qualifying child for more than one person.

- Review your entries carefully to ensure accuracy.

- Once completed, you can save changes, download, print, or share the form as needed.

Start filling out your IRS 8862 (SP) form online today to ensure you claim the credits you deserve.

Related links form

The Additional Child Tax Credit is a refundable credit that you may receive if your Child Tax Credit is greater than the total amount of income taxes you owe. For instance, if you're eligible for a $2,000 Child Tax Credit and your taxes are only $1,000, you may add the remaining $1,000 credit to your refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.