Loading

Get Instructions For Form It-201-x - Tax.ny.gov - New York State

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Instructions For Form IT-201-X - Tax.NY.gov - New York State online

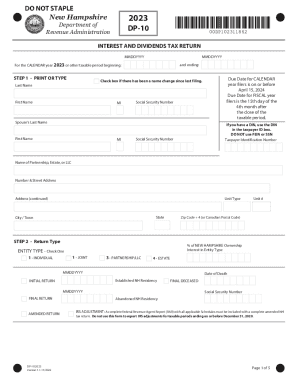

Filling out Form IT-201-X online is an essential step for individuals looking to amend their New York State tax returns. This guide will provide clear, step-by-step instructions to ensure you complete the process accurately and efficiently.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to obtain the form and access it in your document editor.

- Begin by reading the instructions thoroughly to understand the requirements for the amendment.

- Enter your personal information as requested, including your name, taxpayer identification number, and contact details. Make sure all entries are accurate and match your previous filing.

- Indicate the year of the tax return you are amending and the reason for the amendment in the designated fields.

- Fill out the sections regarding your original return and the changes you are making, ensuring to provide all necessary figures and supporting documentation.

- Complete any additional questions or sections that apply to your situation to ensure all relevant information is provided.

- Review the completed form carefully for any errors or omissions before finalizing.

- Once you are satisfied with the form, save your changes, download a copy for your records, and print the form for submission or sharing.

Complete your tax documents online to ensure accuracy and efficiency.

If you need to change or amend an accepted New York State Income Tax Return for the current or previous Tax Year you need to complete Form IT 201-X. Form IT 201-X is a Form used for the Tax Return and Tax Amendment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.