Loading

Get Nh Dp-2848 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NH DP-2848 online

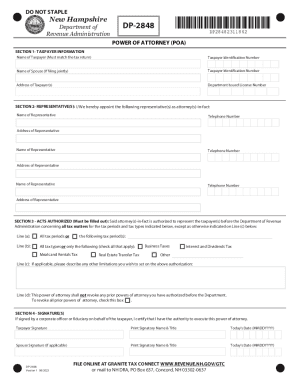

The New Hampshire DP-2848 is a Power of Attorney form that allows taxpayers to authorize representatives to act on their behalf. This guide provides clear, step-by-step instructions on how to complete the form online.

Follow the steps to successfully complete the NH DP-2848.

- Press the ‘Get Form’ button to access the NH DP-2848 Power of Attorney form and open it in your document editor.

- In Section 1, enter the taxpayer's name as it appears on the tax return, their taxpayer identification number, and the current address including zip code. If applicable, include the spouse's name and taxpayer identification number.

- In Section 2, list the representative(s) you wish to appoint. Provide their names, telephone numbers, and addresses. Ensure that you indicate whether the representative is an individual or a firm.

- Complete Section 3 by specifying the acts authorized. For Line (a), choose whether the representative is authorized for all tax periods or specify certain tax periods. For Line (b), check the applicable tax types that the representation covers.

- On Line (c), you may include any specific limitations applicable to the representation. Line (d) allows you to indicate whether previous powers of attorney should be revoked.

- In Section 4, provide the signature of the taxpayer and, if applicable, the spouse. Also, enter the printed name, title (if signed by a corporate officer), and the date of signing.

- After completing the form, you can save your changes, download a copy, print it, or share the form as needed.

Complete your NH DP-2848 form online today and ensure your representation is authorized.

Overview of New Hampshire Taxes Gross Paycheck$3,146Federal Income11.75%$370State Income0.00%$0Local Income0.00%$0FICA and State Insurance Taxes7.65%$24123 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.