Loading

Get Sc1120s-wh - Sc Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC1120S-WH - SC Department of Revenue online

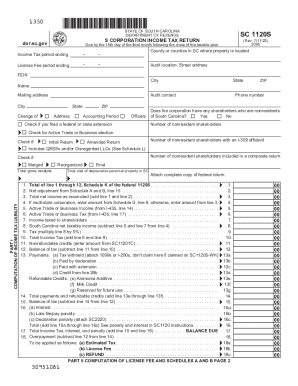

Filing the SC1120S-WH form is an essential task for S corporations in South Carolina to report their income and calculate taxes owed. This guide will provide clear, step-by-step instructions on completing the form online, ensuring accuracy and compliance with South Carolina Department of Revenue requirements.

Follow the steps to fill out the SC1120S-WH effectively.

- Click the ‘Get Form’ button to access the SC1120S-WH form and open it for editing.

- Enter the income tax period ending date in the designated field, ensuring the format is correct.

- Provide the license fee period ending date, as well as the county or counties in South Carolina where property is located.

- Input your Federal Employer Identification Number (FEIN), along with your mailing address and phone number.

- Indicate whether the corporation has any nonresident shareholders by checking 'Yes' or 'No'.

- If applicable, check the boxes for any extensions filed and the nature of your return, such as 'Initial Return' or 'Amended Return'.

- In Part I, begin the computation of income tax liability. Enter total gross receipts and follow through the calculations provided in the form.

- Attach a complete copy of your federal return as instructed.

- Proceed to Part II regarding the computation of the license fee, ensuring all calculations are precise, and refer to the supporting schedules if necessary.

- Complete the refund options section, selecting either direct deposit or paper check for any refund due.

- Review all fields for accuracy and completeness, then save your changes. You may also download, print, or share the completed document as needed.

Complete the SC1120S-WH form online today for a seamless filing experience.

the SC1120-T, Application for Automatic Extension of Time to File a Corporate Tax Return, by the. original due date. There is no extension for payment for Corporate Income Tax or License Fee. Any Income Tax or License Fee due must be paid by the due date to avoid late penalties and. interest�

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.