Loading

Get Irs 1120-c 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-C online

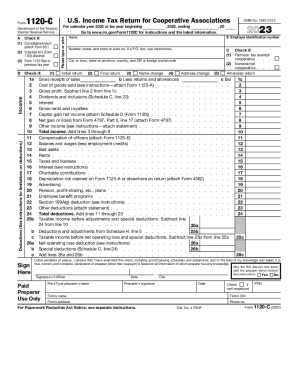

Filing the IRS 1120-C form is essential for cooperative associations to report their income, deductions, and tax liabilities. This guide provides clear, step-by-step instructions for users to fill out the form online, ensuring accuracy and completeness.

Follow the steps to fill out the IRS 1120-C effectively.

- Press the ‘Get Form’ button to download the IRS 1120-C form and access it in your online editor.

- Fill in basic information at the top of the form, including your cooperative's name, employer identification number (EIN), and address. Indicate the tax year for filing.

- In section A, check the boxes that apply to your return, such as whether it's a consolidated return or an amended return.

- Enter your gross receipts or sales in line 1a, subtract any returns and allowances on line 1b, and calculate your gross profit in line 1c.

- Report all income sources like dividends, interest, and capital gains in the respective lines, then calculate your total income.

- Document your deductions in lines 11 through 23, including compensation, rents, taxes, and other allowable expenses.

- Calculate your taxable income by subtracting total deductions from total income, as noted in line 24.

- Complete any applicable schedules, including Schedule C for dividends, Schedule G for income allocation, and Schedule J for tax computation.

- Review your entries for accuracy. Once confirmed, you can save your changes, download your completed form, or print it for submission.

Start filling out your IRS 1120-C form online today to ensure compliance and timely submission.

Schedule C of Form 1120 is where a C corporation reports dividends received from both foreign and domestic subsidiaries, including income from debt-financed and public utility stock, as well as earnings from affiliates and other entities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.