Loading

Get Irs Form 14764 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 14764 online

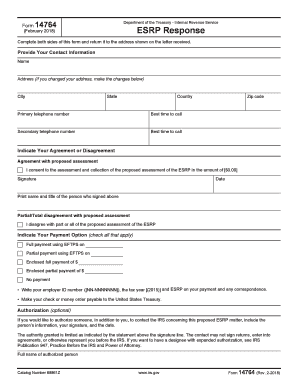

IRS Form 14764 is used to respond to proposed assessments regarding the Employer Shared Responsibility Payment. Understanding how to properly complete this form online is essential for accurate and timely submission. This guide provides detailed instructions to help users navigate the form with ease.

Follow the steps to complete the IRS Form 14764 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your contact information. Fill out your name, address, city, state, country, primary telephone number, best time to call, secondary telephone number, and best time to call, along with your zip code.

- Indicate your agreement or disagreement with the proposed assessment. If you agree, check the box for 'Agreement with proposed assessment' and enter the proposed amount. Be sure to sign and date this section. If you disagree, select the 'Partial/Total disagreement with proposed assessment' option.

- Select your payment option. Check all that apply, such as full payment using EFTPS, partial payment using EFTPS, or indicating enclosed payments. Ensure to write your employer ID number, tax year, and 'ESRP' on your payment and any correspondence. Make checks or money orders payable to the United States Treasury.

- If you wish to authorize someone else to discuss the proposed ESRP matter with the IRS, fill out the authorized person's details in the authorization section. Include their full name, address, city, state, country, primary and secondary telephone numbers, best times to call, and your signature and date.

- Finally, review all the information you have entered for accuracy. Once confirmed, proceed to save your changes, download, print, or share the completed form as necessary.

Start filling out your IRS Form 14764 online today for a smooth and efficient process.

The penalty is assessed monthly and is equal to the number of FTE employees (minus the first 30) multiplied by one-twelfth of $2,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.