Loading

Get 2010 Form 1040 (schedule C-ez) - Irs - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Form 1040 (Schedule C-EZ) - IRS - Irs online

Filling out the 2010 Form 1040 (Schedule C-EZ) can seem daunting, but with a clear guide, you can navigate through it easily. This comprehensive guide will help you understand each section of the form and provide you with the information needed to complete it accurately online.

Follow the steps to successfully fill out your Schedule C-EZ online.

- Click ‘Get Form’ button to access the Schedule C-EZ and open it in your preferred PDF editor.

- In the upper portion, enter your social security number in the designated field. Ensure that it is accurate to prevent any issues.

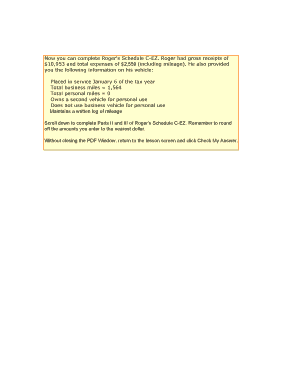

- Fill in the gross receipts amount you earned from the business in the first line of Part II. In Roger's case, this amount is $10,953.

- Calculate the net profit by subtracting total expenses from gross receipts on the third line of Part II. The result will be reported on your Form 1040.

- Detail the total number of miles driven for business in the appropriate section. Roger's total business miles are 1,564.

- Review all the information for accuracy and completeness before finalizing your form. Ensure that you have rounded off all amounts to the nearest dollar.

Complete your Schedule C-EZ online today to ensure accurate reporting and compliance with IRS requirements.

Schedule B is an IRS tax form that must be completed if a taxpayer receives interest income and/or ordinary dividends over the course of the year of more than $1,500. The schedule must accompany a taxpayer's Form 1040. Taxpayers use information from Forms 1099-INT and 1099-DIV to complete Schedule B.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.