Loading

Get Print Instructions Instructions For Completing Application For Homeowners Insurance (numbers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the print instructions for completing application for homeowners insurance online

Filling out the application for homeowners insurance can be straightforward when you have clear instructions. This guide will provide you with step-by-step support to ensure you complete the form correctly.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to obtain the application and open it in the editor.

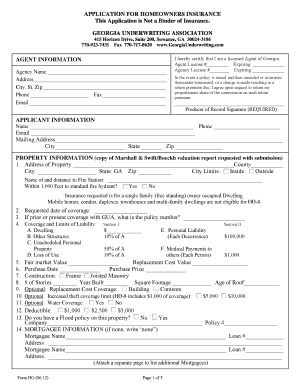

- Begin with the agent information section. Enter the agency name, address, phone, email, license number, and signatures where required. Ensure all fields are accurately filled out.

- Move to the applicant information section. Provide your name, phone, email, and mailing address. This establishes your identity as the insured party.

- Fill out the property information section. Enter the address of the property, county, and fire safety details. Verify that the insurance requested is applicable to a single-family, owner-occupied dwelling.

- Complete the coverage and limits of liability section. Input the requested amount for dwelling coverage, which is the main insurance coverage needed.

- Optional coverages: Indicate your choice for replacement cost coverage, increased theft coverage, and water coverage as needed. Use the specified additional premiums for these coverage items.

- In the mortgagee section, list the name, mailing address, and loan number for each mortgagee. If more space is needed, attach a separate list.

- If there are no claims to report, write 'NONE.' For other claims, provide detailed information, including cause, origin, and repairs made.

- Complete any additional information sections, addressing all occupancy requirements and confirming details about the property.

- Review the checklist to ensure all items have been answered. Missing information may delay processing your application.

- Once completed, save your changes in the editor. You can choose to download, print, or share the form based on your submission preferences.

Start filling out your homeowners insurance application online today!

Florida doesn't require homeowners insurance by law, but if you finance your home, your lender may require you to have a homeowners insurance policy in place. Your policy's coverages are designed to safeguard your property and assets.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.