Loading

Get Applying For Tax Exempt Statusinternal Revenue Service - Irs...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Applying For Tax Exempt Status Internal Revenue Service - IRS online

Filing for tax-exempt status can be a crucial step for organizations seeking to operate without tax burdens. This guide will walk you through the process of filling out the application online, ensuring clarity and comprehensive support throughout each section.

Follow the steps to successfully complete the tax exempt status application

- Click ‘Get Form’ button to obtain the form and open it in the appropriate online interface.

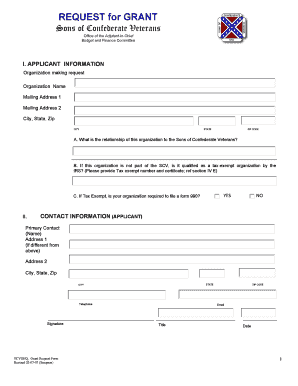

- Begin by providing your organization’s information, including the name and mailing address. Be sure to list the city, state, and zip code accurately to ensure proper communication.

- Indicate the relationship of your organization to the Sons of Confederate Veterans. If applicable, provide your tax-exempt number and certificate as evidence of status.

- Provide contact information for the primary representative of the organization, including their name, address, telephone number, signature, email, title, and date.

- In the project information section, describe your project title and summarize its nature. Be concise and focused in your description.

- Specify the stage of your project (planning, underway, ongoing, completed) and indicate the anticipated completion date.

- Detail the total cost of the project and the amount of funding you are requesting. Additionally, outline other funding sources involved.

- Summarize how the funds received will benefit the organization and what recognition will be given for support.

- Attach supplemental and financial information as per the requirements. This may include a budget, timeline, and any supporting documents demonstrating your tax-exempt status.

- Once all sections are filled out, review your application for accuracy and completeness. Save your changes, and prepare to download, print, or share the form as needed.

Start your online application for tax exempt status today to help your organization operate more effectively.

To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application. The application must be submitted electronically on Pay.gov and must, including the appropriate user fee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.