Loading

Get Tc43031 Zap Part-year &amp - Tax Idaho

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TC43031 Zap Part-Year Tax Idaho online

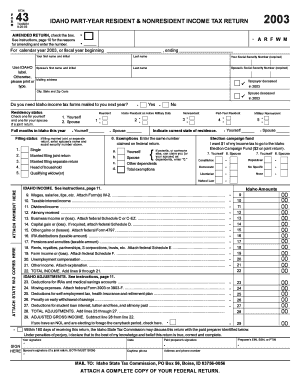

The TC43031 Zap Part-Year Tax Idaho form is essential for individuals who have lived in Idaho for part of the year and earn income. This guide provides a clear, step-by-step approach to filling out the form online, ensuring that users of all experience levels can complete it accurately.

Follow the steps to successfully complete your tax form.

- Press the ‘Get Form’ button to access the TC43031 form and open it in your editor.

- Begin by selecting your residency status. Indicate whether you are a resident, non-resident, or part-year resident by checking the appropriate box. Provide your name, Social Security number, and any pertinent details for your spouse if filing jointly.

- Fill in the mailing address where you would like your tax documents sent. Indicate whether you need Idaho income tax forms mailed to you next year.

- In the exemptions section, enter the number of exemptions you are claiming as indicated in your federal tax return. Be sure to include any dependents if applicable.

- Declare your income by entering amounts in the appropriate fields for wages, interest income, dividends, and any other sources of income. Ensure you attach all necessary Form W-2 and supporting documents.

- Calculate and enter your Idaho adjustments based on deductions such as IRA and moving expenses. Add these adjustments to arrive at your Adjusted Gross Income.

- Complete the standard or itemized deductions section. Choose the larger of the standard deduction or your itemized deductions from federal Schedule A.

- Calculate your Idaho taxable income and follow the scheduling instructions to assess your tax due. Enter the applicable tax credits you qualify for.

- Finalize the form by reviewing all entries for accuracy. Use your digital signature to sign the document and provide the date.

- Once all sections are complete, save your changes, then download, print, or share the TC43031 form as necessary.

Complete your TC43031 form online today for a seamless tax filing experience.

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.