Loading

Get Ak Dor 6390 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK DoR 6390 online

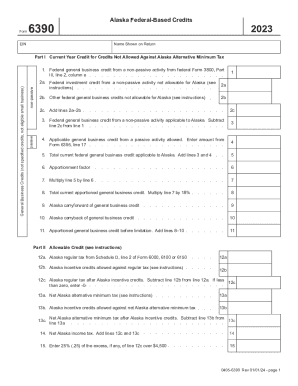

The AK DoR 6390 form is essential for reporting federal-based credits to the state of Alaska. This guide provides clear steps to help users navigate the online process and complete the form accurately.

Follow the steps to successfully complete the form online.

- Click 'Get Form' button to access the form and open it in your preferred online editor.

- Begin with the section labeled 'Name shown on return'. Enter the name as it appears on your federal tax return.

- In Part I, provide your Employer Identification Number (EIN) as required. This ensures accurate identification of your business.

- Fill in the current year credit details for credits not allowed against the Alaska Alternative Minimum Tax. Reference your federal Form 3800 for information on lines 1 through 5.

- Complete the apportionment factor in line 6 based on the specifics of your business operations.

- For each applicable section regarding federal general business credits, carefully enter the values from the prescribed federal forms, ensuring all additions and subtractions are calculated correctly.

- Continue to Part II and Part III, where you will detail allowable credits and specify whether they are active or passive. Follow the instructions diligently to ensure compliance.

- Once all sections are completed, review your entries for accuracy and completeness.

- Finally, save your changes, then download or print the completed form for your records or further submission.

Start filling out your documents online today to ensure timely and accurate filing.

A credit of up to $6 million per year for taxpayers incurring eligible oil and gas lease expenditures in areas of the state other than the North Slope and Cook Inlet aka “Middle Earth”. A credit of up to $12 million per year is available for taxpayers incurring eligible oil and gas lease expenditures.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.