Loading

Get Instructions For Form N-35, Rev. 2023, S Corporation ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Instructions For Form N-35, Rev. 2023, S Corporation ... online

Filling out Form N-35, Rev. 2023, S Corporation, can be a straightforward process when approached step by step. This guide provides detailed instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name shown on the return and the employer identification number (EIN). Ensure all entries are accurate and consistent with your records.

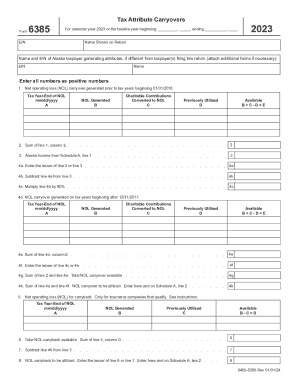

- For line 1, enter the net operating loss (NOL) carryover generated prior to tax years beginning 01/01/2018. Specify the tax year-end and include the relevant amounts.

- For lines 2 through 4, calculate the respective amounts. Ensure to follow the formula for each line carefully, such as for line 4a, where you need to enter the lesser of line 2 or line 3.

- Continue filling in lines 4d to 4h, ensuring to calculate the previously utilized amounts and NOL carryovers accurately.

- Proceed to lines 5 through 8, which relate to NOL carryback calculations. Take care to follow the instructions for insurance companies if applicable.

- Fill out lines 9 through 18 regarding capital loss carryovers and charitable contributions. Make sure to calculate the total available amounts and ensure accurate reporting in the designated sections.

- Once you have filled in all sections and verified the accuracy of your entries, you can save changes, download, print, or share the form as needed.

Complete your documents online today to ensure timely and accurate submissions.

California corporations and S-corps are generally subject CA franchise tax. The California Minimum Franchise Tax of $800 will be automatically calculated for applicable corporate and S corp returns on CA Form 100, page 2, line 23 or CA Form 100S, page 2, line 21.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.