Loading

Get Sc Dor Sc1120 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1120 online

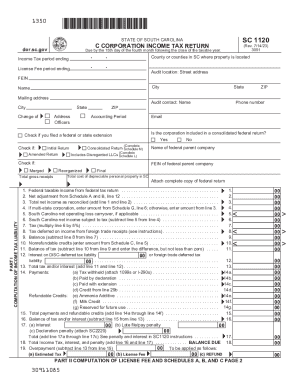

The SC DoR SC1120 is the South Carolina C Corporation Income Tax Return form, which businesses must complete to report their income and expenses. This guide provides step-by-step instructions for effectively filling out the SC1120 online, ensuring you provide all necessary information accurately and efficiently.

Follow the steps to complete your SC DoR SC1120 form online.

- Click the ‘Get Form’ button to download the SC DoR SC1120 form and open it in your chosen editor.

- Enter the income tax period ending date, followed by the license fee period ending date in the respective fields at the top of the form.

- Provide the county or counties in South Carolina where your property is located. Fill in the audit contact name along with the complete street address and city of the audit location.

- Input the Federal Employer Identification Number (FEIN) of your corporation, along with the corporation's name and mailing address.

- Indicate whether the corporation is included in a consolidated federal return by selecting 'Yes' or 'No'. If applicable, provide the name and FEIN of the federal parent company.

- Complete fields regarding changes of address and list all officers of the corporation, including their contact information.

- Provide details about your accounting period, indicate if this is an initial return, amended return, or includes disregarded LLCs, and other relevant checkboxes.

- Fill in the total gross receipts and total cost of depreciable personal property in South Carolina while attaching a complete copy of the federal return.

- Calculate the federal taxable income from your federal tax return, net adjustment as per Schedule A and B, leading to the total net income as reconciled.

- Continue filling out the tax calculations including South Carolina net operating loss carryover and the amount subject to tax. Apply the appropriate tax rates as outlined.

- Provide any interest, penalties, and calculations for payments and credits as necessary to comply with all requirements.

- Complete the schedule sections including Schedules A, B, C, and any required schedules specific to your corporation’s situation.

- Review the form for accuracy. Once completed, save your changes, then download or print a copy of the SC1120 for your records.

- Submit the form as directed based on whether there is a payment due or you are requesting a refund.

Complete your SC DoR SC1120 online today for efficient processing!

Start an LLC in South Carolina Step 1: Name your South Carolina LLC. Step 2: File articles of organization. Step 3: Choose a registered agent. Step 4: Create an operating agreement. Step 5: Apply for an EIN. Step 6: Comply with South Carolina's tax requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.