Loading

Get Formulario 8300 Del Irs: Qu Es Y Por Qu Es Importante?

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Formulario 8300 del IRS: Qu es y por qu es importante? online

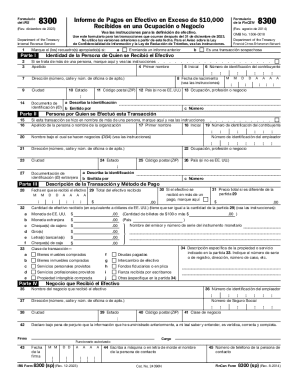

The Formulario 8300 del IRS is a crucial document for reporting cash transactions exceeding $10,000 in a business or occupation. Understanding how to fill out this form correctly is essential to comply with federal regulations and avoid potential penalties.

Follow the steps to effectively complete the Formulario 8300 online.

- Press the 'Get Form' button to access the form and open it in your preferred PDF editor.

- In Part I, provide the identity information of the person from whom you received the cash. Fill in their last name, first name, initial, and taxpayer identification number. Also, complete their birth date, address, city, state, ZIP code, and country if not in the US.

- In Part II, if the cash transaction was made on behalf of multiple people, check the appropriate box and fill out their details in the same format as in Part I.

- In Part III, describe the transaction that involved cash. This includes the date you received the cash and the total amount received. Differentiate between payments if necessary and ensure that the total cash amount aligns with the previous figures.

- Detail the method of payment in Part III, indicating whether it was received in US or foreign currency, checks, or any other financial instruments.

- In Part IV, specify the nature of the transaction, such as purchased goods or services, and include a clear description of the items or services transacted.

- Complete the section for the business that received the cash, offering its name, address, and employer identification number.

- Finally, after ensuring all fields are accurately filled, save changes to your document. You can then download, print, or share the filled-out Formulario 8300 as needed.

Take the necessary steps today to complete important tax documents online efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Una vez que una persona recibe (en una transacción o transacciones relacionadas) efectivo que excede los $10,000 en el comercio o negocio de una persona, se debe presentar un Formulario 8300 .

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.