Loading

Get Irs 5472 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5472 online

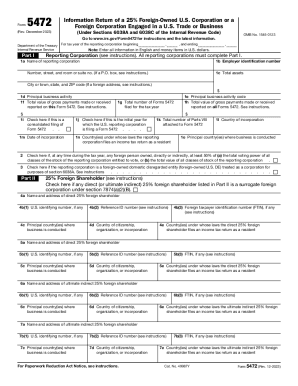

Filing the IRS Form 5472 is crucial for U.S. corporations that are at least 25% foreign-owned or foreign corporations engaged in a U.S. trade or business. This guide will provide you with clear, step-by-step instructions on how to complete this form accurately online.

Follow the steps to fill out the IRS Form 5472 online effectively.

- Click ‘Get Form’ button to obtain the IRS Form 5472 and open it in your preferred editing tool.

- In Part I, enter the tax year for which the reporting corporation is filing, ensuring to use English and report monetary amounts in U.S. dollars.

- Complete the fields for the reporting corporation’s name, employer identification number, total assets, and principal business activity. Ensure you provide accurate information.

- Fill in the total value of gross payments made or received and indicate if this is a consolidated filing. Additionally, check if this is the initial year filing or list the number of forms filed.

- In Part II, provide the necessary information regarding the 25% foreign shareholders, including names, addresses, and relevant country information.

- Part III requires details on related parties. Specify their information and the nature of the relationship.

- Complete Part IV by detailing all monetary transactions between the reporting corporation and foreign related parties. Be thorough in reporting sales, purchases, and other transactions.

- Proceed to Part VII to answer additional questions about the reporting corporation’s import activities and other financial details pertaining to cost sharing arrangements.

- Finally, ensure all parts of the form are filled in, review the information for accuracy, and make any necessary adjustments. Save your changes, and download, print, or share the completed form as needed.

Start filling out your IRS Form 5472 online today to ensure compliance and accuracy.

How to File Forms 5472 and 1120 for a Foreign-Owned Single Member... Get an Employer Identification Number (EIN) In order to file Form 5472, you have to apply for a U.S Employer Identification Number, or EIN. ... Fill out Form 5472. ... Fill out Pro Forma Form 1120. ... 4. Mail or Fax Forms 5472 and 1120 to the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.