Loading

Get Irs Instruction 8863 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 8863 online

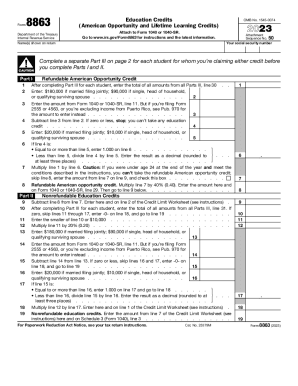

Filling out the IRS Instruction 8863 is essential for claiming education credits such as the American Opportunity Credit and the Lifetime Learning Credit. This guide provides clear, step-by-step instructions tailored to help users navigate the online form effectively.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to access the IRS Instruction 8863 online and open it in your preferred editor.

- Carefully complete Part I of the form, starting with entering your total amounts from Parts III related to each student.

- Follow the guidelines to fill in the refundable American Opportunity Credit section, making sure to accurately report income levels and any applicable conditions.

- Complete Part II to calculate nonrefundable education credits by carefully entering the necessary totals as instructed.

- Proceed to Part III where you will enter detailed information for each student you are claiming credits for, including their names, educational institutions, and related information.

- Review all sections meticulously, ensuring that no fields are left incomplete or inaccurately filled.

- Once satisfied with the entries, save changes to the form and proceed to download, print, or share the completed document as required.

Get started on filing your IRS Instruction 8863 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Use Form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. There are two education credits: The American Opportunity Credit, part of which may be refundable. The Lifetime Learning Credit, which is nonrefundable.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.