Loading

Get Understanding Schedule M-3 On Irs Form 1065

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Understanding Schedule M-3 on IRS Form 1065 online

Filling out Schedule M-3 on IRS Form 1065 can seem challenging, but this guide will provide you with clear, step-by-step instructions. By following these directions, you'll be able to complete this essential tax document with confidence.

Follow the steps to effectively complete Schedule M-3.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

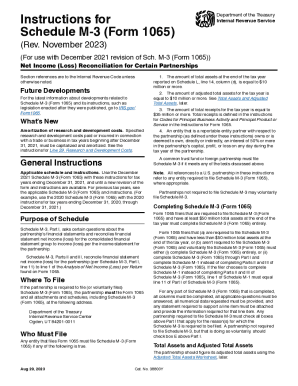

- Review the general instructions provided for Schedule M-3. Understand when your partnership is required to file this schedule based on total assets and receipts.

- Complete Part I, which requires questions concerning the partnership's financial statements and reconciles financial statement net income or loss to income or loss reported on Form 1065.

- In Part II, reconcile the financial statements' net income (loss) with income (loss) reported on the partnership's return. Ensure to appropriately classify any differences.

- Progress to Part III, where you will detail additional adjustments or differences in income or expenses, ensuring proper documentation and explanations for each item.

- Once all parts are completed, carefully review the form for accuracy and completeness.

- Finally, save your changes, download the completed form, print it if needed, or share it as required.

Start filling out your Schedule M-3 online today to ensure your partnership remains compliant with IRS regulations.

The amount reported in Box 20, Code M is the taxpayer's share of any recapture of section 179 expense deduction if the business use of the property dropped to 50% or less. See the partner's instructions provided by the partnership for further information on the treatment that these items will receive.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.