Loading

Get Nc Ncui 685 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC NCUI 685 online

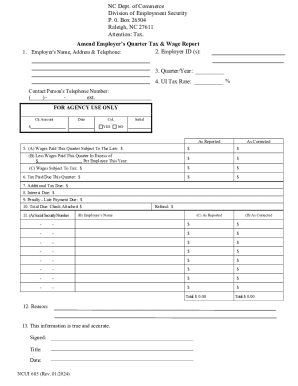

Filling out the NC NCUI 685 online is a straightforward process that helps employers amend their quarterly tax and wage reports. This guide provides a comprehensive overview of each section and field of the form to assist users in accurately completing it.

Follow the steps to successfully complete the NC NCUI 685 online.

- Press the ‘Get Form’ button to access the NC NCUI 685 form and open it in your preferred online editor.

- Enter the employer's name, mailing address, and contact person's telephone number in the spaces provided at the top of the form.

- Input the employer account ID issued by the agency in the designated fields. If applicable, include both the consolidated account number and branch account number for accurate reporting.

- Specify the quarter and year that you are correcting, using the format Q-YYYY, for example, 1-2023. Remember to submit a separate form for each quarter needing correction.

- Indicate the applicable UI tax rate for the year being amended in the provided section.

- (A) Report the total wages paid this quarter subject to the law. (B) Subtract any excess wages per employee this year and (C) calculate the wages subject to tax, including the as reported and as corrected amounts.

- Enter the tax due this quarter in the appropriate fields, reporting both the previously paid amount and the corrected total.

- Calculate any additional tax due if the as corrected amount is higher than what was reported.

- If additional tax is due, compute interest based on the prescribed monthly interest rate, considering the relevant due date.

- Calculate the penalty for late payment, which is 10 percent of the amount due if applicable.

- Total the amounts due, including additional tax, interest, and penalties. Indicate if a check is attached for payments or if a refund is due.

- Complete the section for individual employee wage corrections, entering their Social Security number, name, previous wages, and corrected amounts as necessary.

- Provide a brief reason for the adjustments made on the form.

- Sign and date the form before submitting it via mail to the address specified for the NC Department of Commerce.

- Finally, review your filled-out form for any errors, and save, download, print, or share the form as required.

Begin filling out your NC NCUI 685 online today to ensure your tax filings are accurate and up to date.

Form NCUI-101 - This form is used to submit required employer contributions to the NC state unemployment fund. Form NC5 or NC5Q - This form reports to the NC Department of Revenue the amount of state income tax withholding for the quarter. Filers of Form NC5Q pay the state withholding each payroll.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.