Loading

Get Wi Wt-11 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI WT-11 online

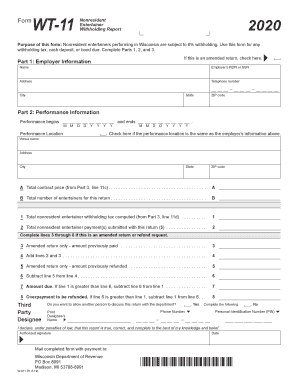

The WI WT-11 form is essential for nonresident entertainers performing in Wisconsin, as it ensures compliance with withholding tax regulations. This guide provides detailed, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the WI WT-11 online with ease.

- Press the ‘Get Form’ button to download the WI WT-11 and open it on your device.

- Begin with Part 1: Employer Information. Fill in the employer's name, federal employer identification number (FEIN) or social security number (SSN), address, telephone number, city, state, and ZIP code. Ensure all information is accurate as it pertains to the employer that will report the withholding tax.

- Move to Part 2: Performance Information. Enter the beginning and ending dates of the performance in the appropriate fields. If the performance location is the same as the employer’s information, mark the corresponding box. If different, provide the venue's address, city, state, and ZIP code.

- Record the total contract price in line A. This amount should reflect the total payment agreed upon for the performance, which comes from Part 3, line 11c. Also, indicate the total number of entertainers related to this return in line B.

- Complete lines 1 and 2 with the total nonresident entertainer withholding tax computed (from Part 3, line 11d) and the total payments submitted with this return, respectively.

- If this is an amended return or a refund request, complete lines 3 through 8. Line 3 asks for the amount previously paid, while line 5 is for the amount previously refunded. Line 6 requires you to subtract line 5 from line 4, while line 7 and line 8 calculate the amount due or overpayment to be refunded.

- In the Third Party Designee section, indicate if another person is allowed to discuss this return with the department. Provide their name, phone number, and personal identification number (PIN) if applicable.

- Finish the form with your authorized signature and the date. This declaration affirms that the information provided is true and complete to the best of your knowledge. Ensure to mail the completed form along with any required payment to the Wisconsin Department of Revenue.

Start filling out your WI WT-11 online today to ensure compliance and ease of submission.

Wisconsin workers are subject to a progressive state income tax system with four tax brackets. The tax rates, which range from 3.50% to 7.65%, are dependent on income level and filing status. How many allowances should you claim? Most people claim 0-5 allowances, check W-4 rules for details.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.