Loading

Get Ok Sos Form 008 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK SOS Form 008 online

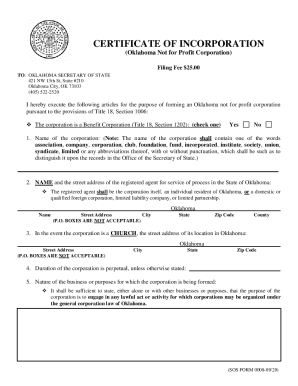

Completing the OK SOS Form 008 online is a straightforward process that helps you establish a not-for-profit corporation in Oklahoma. This guide will provide you with step-by-step instructions to ensure you fill out the form correctly.

Follow the steps to complete the OK SOS Form 008 online.

- Click the ‘Get Form’ button to access the form and open it in the online editor.

- Enter the name of the corporation, ensuring it includes one of the specified terms such as 'association' or 'corporation'. Verify that the name is unique by checking it with the Secretary of State.

- Input the name and street address of the registered agent in Oklahoma. This agent will accept legal documents on behalf of the corporation.

- If applicable, provide the street address of the church’s location. Note that this cannot be a P.O. box.

- Specify the duration of the corporation, which is typically perpetual unless noted otherwise.

- Describe the purpose of the corporation, indicating it will engage in lawful activities as allowed under Oklahoma law.

- State that the corporation does not have authority to issue capital stock.

- Confirm that the corporation is not for profit and does not provide financial gain to its members.

- Indicate the number of trustees or directors that will be elected at the first meeting, ensuring at least one trustee or director is listed.

- Provide the names and mailing addresses of the trustees or directors.

- List the names and mailing addresses of a minimum of three incorporators.

- Enter the email address of the primary contact for the business.

- Ensure all incorporators sign the certificate of incorporation and date their signatures.

- Save your changes, then download, print, or share the completed form as necessary.

Complete your OK SOS Form 008 online today to successfully establish your not-for-profit corporation.

An LLC and a Limited Partnership must also pay an annual fee of $25.00 (LLC) and $55.00 (Limited Partnership) to the SOS to keep its registration active and in good standing. A corporation must file an annual franchise tax return with the Oklahoma Tax Commission and, if owed, pay a franchise tax amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.