Loading

Get Mo Mo-1120s 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-1120S online

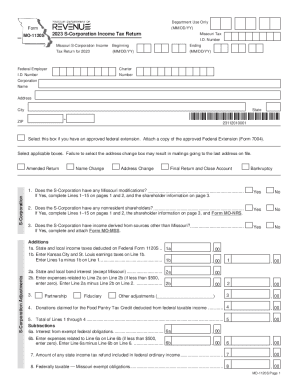

This guide provides a clear, step-by-step process for completing the MO MO-1120S online. Whether you are a seasoned professional or new to tax forms, this guide aims to support you through the process.

Follow the steps to fill out the MO MO-1120S form accurately.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Enter the Missouri Tax I.D. number, federal employer I.D. number, and corporation name at the top of the form. Provide the full address including city, state, and ZIP code.

- Indicate if you have an approved federal extension by selecting the appropriate box and attaching a copy of the approved Federal Extension (Form 7004) if applicable.

- Respond to the questions regarding Missouri modifications, nonresident shareholders, and income sources. Complete Lines 1–15 on pages 1 and 2 as specified based on your answers.

- Fill out the additions and subtractions sections accurately. Input the relevant amounts in Lines 1a through 14 according to your financial details. Ensure that all calculations are correct.

- Complete the signature section, ensuring it is signed and dated by the officer of the corporation. Include their printed name and contact telephone number.

- If applicable, provide information about the tax return preparer, including their name, signature, and IRS preparer tax identification number.

- Once all fields are completed, review the form thoroughly for accuracy. After ensuring all information is correct, you can save the changes, download, print, or share the form as needed.

Complete the MO MO-1120S online to ensure accurate and timely submission of your S-Corporation income tax return.

How is book income calculated on Schedules M-1 and M-3 on Form 1120-S? Schedule M-1 is required when the corporations gross receipts or its total assets at the end of the year are greater than $250,000. The calculation for Schedule M-1 is done in reverse from the form itself.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.