Loading

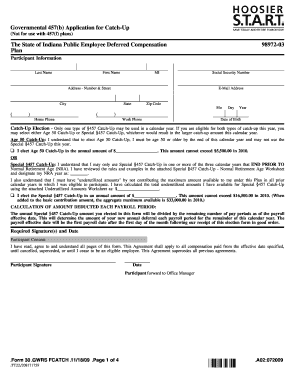

Get In Governmental 457(b) Application For Catch-up Form 30 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Governmental 457(b) Application for Catch-Up Form 30 online

Filling out the IN Governmental 457(b) Application for Catch-Up Form 30 online can be straightforward with the right guidance. This guide will take you through each step to ensure that you complete the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin with the participant information section. Fill in your last name, first name, middle initial, Social Security number, e-mail address, and your address including city, state, and zip code.

- In the catch-up election section, select only one type of §457 catch-up for the calendar year. If eligible for both, calculate which option provides a larger amount and make your selection.

- Sign the participant consent section confirming that you understand and agree to the contents of the form.

- After verifying all entered information for accuracy, save your changes, and download or print the form as needed. You may also choose to share it with relevant parties.

Complete your IN Governmental 457(b) Application for Catch-Up Form 30 online today for a smooth submission experience.

Yes, catch-up contributions can be made for both 403(b) and 457 plans, allowing individuals nearing retirement age to boost their savings. This strategy can be highly effective in ensuring you are financially prepared for retirement. Using resources like the IN Governmental 457(b) Application for Catch-Up Form 30 can assist you in this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.