Loading

Get Id Itd 3823 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ID ITD 3823 online

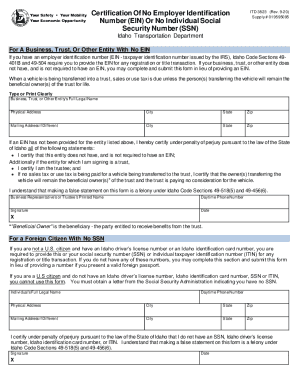

The ID ITD 3823 is a certification form for businesses, trusts, or other entities that do not possess an Employer Identification Number (EIN) or Individual Social Security Number (SSN). This guide provides clear, step-by-step instructions to help you complete the form online accurately.

Follow the steps to successfully fill out the ID ITD 3823

- Click the ‘Get Form’ button to obtain the ID ITD 3823 form and open it in the online editor.

- Begin by entering the full legal name of your business, trust, or other entity in the designated field. Ensure that the name is typed or printed clearly.

- Provide the physical address, including the city, state, and zip code, where your business or trust operates.

- If your mailing address differs from the physical address, complete the mailing address section with the appropriate information, including city, state, and zip code.

- In the certification section, confirm that your entity does not have, and is not required to have, an EIN by checking the appropriate box.

- If applicable, complete the statements regarding trust ownership and confirm whether sales or use tax will be paid for the vehicle being transferred.

- Input your printed name as the business representative or trustee, along with your daytime phone number.

- Sign and date the form to authenticate your certification.

- Review the completed form for accuracy, then save your changes, and choose to download, print, or share the form as needed.

Complete your documents online with ease and confidence.

More In File Every organization must have an employer identification number (EIN), even if it will not have employees. The EIN is a unique number that identifies the organization to the Internal Revenue Service. To apply for an employer identification number, you should obtain Form SS-4PDF and its InstructionsPDF.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.