Loading

Get Ca De 660 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA DE 660 online

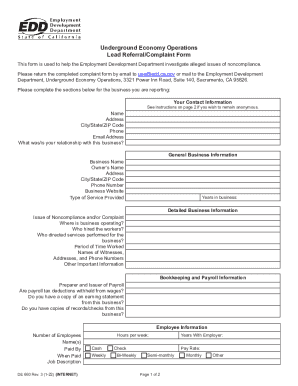

The CA DE 660 form is a vital document for reporting noncompliance related to underground economy operations. This guide provides a step-by-step approach to completing the form online, ensuring your submission is clear and comprehensive.

Follow the steps to successfully fill out the CA DE 660 online.

- Click the ‘Get Form’ button to obtain the form and open it in your browser.

- Begin populating your contact information. Provide your name, address, city/state/ZIP code, phone number, and email address. If you wish to remain anonymous, refer to the instructions on page 2 for guidance.

- Provide details about the business you are reporting. Include the business name, owner's name, address, city/state/ZIP code, phone number, website, type of service offered, and years in operation.

- Detail the issue of noncompliance or complaint. Clearly describe the nature of the problem, such as misclassification of workers or lack of appropriate payment documentation.

- Fill in the specific operating location of the business and identify who hired and directed the workers. This information is crucial for the investigation.

- Indicate the period during which the workers provided their services and list names, addresses, and contact information of any witnesses.

- Input bookkeeping and payroll information, including the preparer of payroll and whether tax deductions are applied to wages. Attach supporting documents if available.

- Complete the employee information section by specifying the number of employees, how they are paid, their job descriptions, and any other relevant payroll details.

- Review all information entered for accuracy and completeness. Make any necessary adjustments.

- Once satisfied with the form, save your changes, download a copy for your records, and submit the completed form via email or mail as directed.

Take action now and complete your documents online to ensure timely processing.

The Employment Development Department's (EDD) Tax Branch works with employers to collect California's employment taxes and data to support the employment security, child support, and personal income tax programs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.