Loading

Get Canada 5006-tg E 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada 5006-TG E online

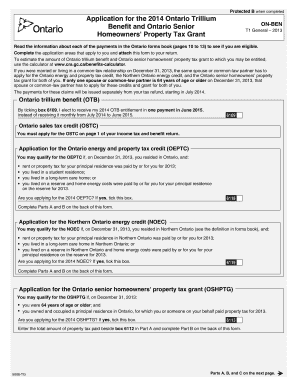

Filling out the Canada 5006-TG E form is essential for applying for various benefits related to taxes and property in Ontario. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently, ensuring you can access the benefits for which you may be eligible.

Follow the steps to complete your application seamlessly.

- Press the ‘Get Form’ button to access the Canada 5006-TG E document. This will open the form in the appropriate editor for your online completion.

- Begin by reviewing the eligibility criteria for the Ontario trillium benefit, Ontario senior homeowners' property tax grant, and other associated credits. Ensure you are qualified before proceeding.

- Fill in your personal information in the designated sections. Make sure to provide accurate details for your circumstances, including if you are applying individually or as part of a couple.

- For the Ontario trillium benefit, tick the box to indicate your election for a single payment if applicable. Complete any surrounding sections with the required information.

- If you are applying for the Ontario energy and property tax credit, indicate your residency status and provide necessary details for your principal residence, including rent and property tax amounts.

- Complete the specific application sections for the Northern Ontario energy credit if you reside in that area. Provide any required figures regarding your property taxes or energy costs.

- For the Ontario senior homeowners' property tax grant, confirm your age eligibility, ownership, and occupancy details for your residence. Enter the total amount of property tax paid.

- Once all applicable sections are filled out, review your entries for accuracy. Make any necessary corrections to ensure completeness.

- When you are finished, you can save your changes, download, print, or share the completed form as needed to submit it with your tax return.

Start filing your Canada 5006-TG E form online today to secure your benefits!

If the Canada fed deposit you receive says DN Canada fed/fed on your bank statement then you're likely receiving a payment for one of three things – Canada Child Benefit, a GST/HST payment, or the Canada Workers Benefit. This is stating that the payment is for a federal benefit not a provincial or territorial one.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.