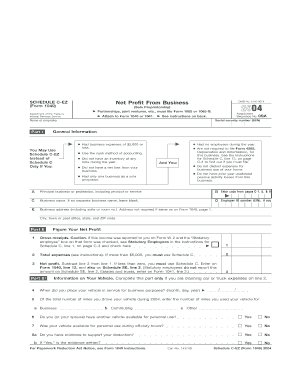

Get Schedule C-ez (form 1040) Department Of The Treasury Internal Revenue Service Net Profit From

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:Feel all the advantages of submitting and completing legal forms online. Using our solution filling in SCHEDULE C-EZ (Form 1040) Department Of The Treasury Internal Revenue Service Net Profit From will take a matter of minutes. We make that possible by giving you access to our feature-rich editor effective at changing/correcting a document?s initial text, adding unique boxes, and e-signing.

Execute SCHEDULE C-EZ (Form 1040) Department Of The Treasury Internal Revenue Service Net Profit From within several minutes following the recommendations listed below:

- Find the template you require from our collection of legal forms.

- Click on the Get form key to open the document and move to editing.

- Fill out the required boxes (they are marked in yellow).

- The Signature Wizard will enable you to put your e-signature as soon as you?ve finished imputing information.

- Insert the relevant date.

- Double-check the whole document to make certain you have filled in everything and no corrections are required.

- Hit Done and download the resulting template to the gadget.

Send your SCHEDULE C-EZ (Form 1040) Department Of The Treasury Internal Revenue Service Net Profit From in an electronic form right after you are done with completing it. Your data is securely protected, as we keep to the most up-to-date security criteria. Join numerous happy users who are already completing legal forms right from their apartments.

Additional Filing Requirements for Schedule C Businesses Calculate the Qualified Business Income Deduction (Section 199A deduction) on Form 8995 or Form 8995-A and report it on Form 1040, Line 13. Most Schedule C businesses with positive net income qualify but see the instructions to Form 8995 to learn more.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.