Loading

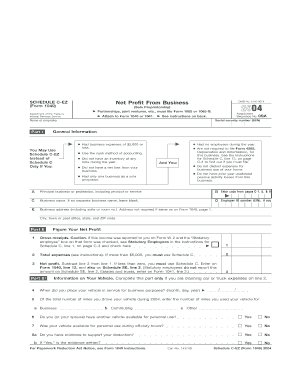

Get Schedule C-ez (form 1040) Department Of The Treasury Internal Revenue Service Net Profit From

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the SCHEDULE C-EZ (Form 1040) Department Of The Treasury Internal Revenue Service Net Profit From online

Filling out the SCHEDULE C-EZ can seem daunting, but this guide will help you understand each section of the form. This form is designed for sole proprietors who meet specific criteria and will allow you to report your net profit from business activities efficiently.

Follow the steps to complete SCHEDULE C-EZ online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your personal information in the top section, including your name, social security number, and the principal business or profession that generated your income. Ensure you include the six-digit business code related to your activity.

- If applicable, provide your employer identification number (EIN) and business address. Remember, the EIN is only necessary for certain tax situations; otherwise, leave this section blank.

- In Part I, report your gross receipts from your business in line 1. Include all taxable income received, ensuring it matches what was reported to you on any relevant Forms 1099-MISC.

- Enter your total business expenses in line 2. Make sure this amount does not exceed $5,000; otherwise, you will need to use Schedule C instead.

- Calculate your net profit by subtracting line 2 from line 1 in line 3. If this results in a negative number, you must switch to Schedule C.

- If you claim vehicle expenses, complete Part III by providing details about your vehicle use including the total miles driven and those specifically for business.

- Once filled out, review the form to check for accuracy. You can then save your changes, download, print, or share the form as necessary.

Start submitting your documents online for easier management and filing.

Related links form

Additional Filing Requirements for Schedule C Businesses Calculate the Qualified Business Income Deduction (Section 199A deduction) on Form 8995 or Form 8995-A and report it on Form 1040, Line 13. Most Schedule C businesses with positive net income qualify but see the instructions to Form 8995 to learn more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.