Loading

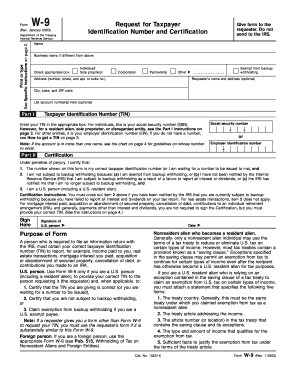

Get Form W-9 (rev. January 2003) - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-9 (Rev. January 2003) - Irs online

Filling out the Form W-9 is an essential step for individuals and entities providing their taxpayer identification number to a requester. This guide offers clear, step-by-step instructions on how to properly complete the form online while ensuring compliance with IRS regulations.

Follow the steps to complete the Form W-9 online.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by filling in your name as it appears on your Social Security card. If your business name differs, provide that as well on the designated line.

- Check the appropriate box to indicate your status (individual/sole proprietor, corporation, partnership, etc.).

- Enter your address, including the number, street, and apartment or suite number, followed by the city, state, and ZIP code.

- In Part I, provide your taxpayer identification number (TIN). For individuals, this is your Social Security number (SSN); for a business entity, this is your employer identification number (EIN).

- Move to Part II and complete the certification section. Confirm that the information provided is accurate and that you are not subject to backup withholding, unless you have been notified otherwise.

- Sign and date the form to validate the information you have entered.

- Once completed, you may save changes, download, print, or share the form as needed. Remember, do not send this form to the IRS; instead, provide it directly to the requester.

Start filling out your Form W-9 online today to ensure compliance and facilitate efficient processing.

Do I Need to Submit a New W-9 Form Annually? Generally speaking, independent contractors only need to submit a W-9 form once, as long as the address and name remain the same. If you are employed by another business or organization, then you may be required to submit a new W-9 form at the beginning of each tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.