Loading

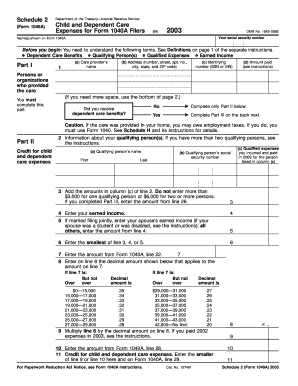

Get 2003 Form 1040a (schedule 2). Child And Dependent Care Expenses For Form 1040a Filers - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2003 Form 1040A (Schedule 2). Child And Dependent Care Expenses For Form 1040A Filers - Irs online

Filing your taxes can be a complex process, but understanding how to complete Form 1040A (Schedule 2) for child and dependent care expenses can help simplify it. This guide provides detailed steps to assist you in accurately filling out the form online.

Follow the steps to complete Form 1040A (Schedule 2) effectively.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred editing software.

- In Part I, provide the name, address, and identifying number (SSN or EIN) of the care provider. Ensure you include the total amount paid in this part.

- Indicate whether you received dependent care benefits by answering the yes or no question at the bottom of Part I. Depending on your answer, proceed to Part II or Part III as instructed.

- In Part II, provide information about your qualifying persons by entering their names and social security numbers in the designated sections.

- Calculate the total qualified expenses you incurred by adding the amounts from column (c) of line 2, ensuring you do not exceed $3,000 for one qualifying person or $6,000 for two or more.

- Enter your earned income and, if applicable, your spouse's income, noting special conditions for spouses who are students or disabled.

- Determine the smallest value from lines 3, 4, or 5 and input this number on line 6.

- Refer to line 7 from Form 1040A and record it in line 7 of Schedule 2.

- Follow instructions to find the applicable decimal amount for line 8 based on your income level noted in line 7.

- Multiply the amount entered on line 6 by the decimal from line 8 to determine your child and dependent care credit.

- Complete Part III if you received dependent care benefits: enter the total benefits received and any forfeited amount, then calculate your excluded benefits and taxable benefits.

- Finalize your calculations, recording the child and dependent care credit on Form 1040A, line 29 after determining the smaller of the calculated amounts.

- Save your changes, download, print, or share the completed form as necessary.

Begin filling out your 2003 Form 1040A (Schedule 2) online today to ensure you maximize your child and dependent care expenses.

You (and your spouse, if you're married) must have "earned income," meaning money earned from a job. Non-work income, such as investment profits, doesn't count. You must have paid for the care so that you could work or look for work.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.