Loading

Get Il Cli138f 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL CLI138F online

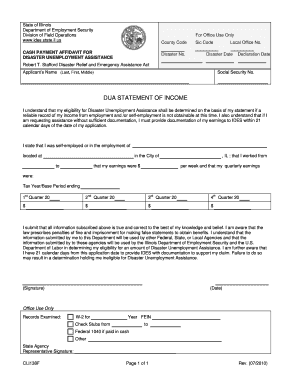

The IL CLI138F is the Cash Payment Affidavit for Disaster Unemployment Assistance. This guide will help you complete the online form accurately to ensure your application is processed efficiently.

Follow the steps to accurately complete the IL CLI138F form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the disaster number. This may be provided by your local office.

- Input the SIC code relevant to your previous employment. This code can often be found through a quick search or should be available from your last employer.

- Provide the local office number which is designated by the Department of Employment Security.

- Next, state the disaster date and declaration date as they pertain to your application.

- Enter your name in the format of last name, first name, and middle initial.

- Input your social security number accurately to avoid processing delays.

- Complete the DUA statement of income section. Provide details of your employment—whether self-employed or otherwise—such as the name of the business, location, earnings, and work period.

- Fill in the quarterly earnings for the applicable tax year or base period. This includes the first to fourth quarter earnings.

- Review your information carefully to ensure accuracy, as false statements can result in penalties.

- Finally, provide your signature and the date to certify the information is correct, then save your changes.

- Download, print, or share the completed form as needed after reviewing for completeness.

Complete the IL CLI138F online now to ensure your application for Disaster Unemployment Assistance is processed without delay.

To fill out self-employment income, start by gathering all relevant income statements, including bank statements, invoices, and receipts. Use the IRS Schedule C, which guides you through detailing your income and expenses related to your business. The IL CLI138F is a resource that can ensure you accurately capture your self-employment earnings. Taking time to prepare correctly will benefit you when filing your taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.