Loading

Get Wi A-006 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI A-006 online

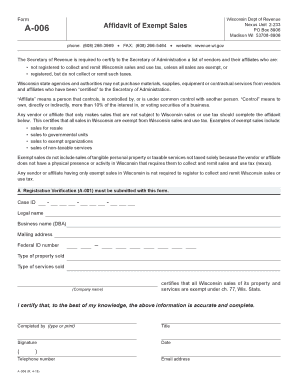

The WI A-006 form is an affidavit of exempt sales used by vendors in Wisconsin to certify that their sales are exempt from sales and use tax. This guide provides step-by-step instructions on how to accurately fill out this form online.

Follow the steps to complete the WI A-006 form online.

- Press the ‘Get Form’ button to access the affidavit and open it in your preferred online editor.

- Enter the Case ID in the designated field to identify your submission.

- Complete the 'Legal name' field with the official name of the vendor or affiliate as registered.

- Fill in the 'Business name (DBA)' section with the name your business operates under, if different from the legal name.

- Provide the 'Mailing address' of your business, ensuring it is accurate for correspondence.

- Input your 'Federal ID number' to verify your business for federal tax purposes.

- Specify the 'Type of property sold'. Indicate what goods you sell that are exempt from tax.

- Indicate the 'Type of services sold'. Provide details about the exempt services you offer.

- Affirm the statement certifying that all Wisconsin sales of your property and services are exempt under ch. 77, Wis. Stats.

- Type or print your name in the 'Completed by' field.

- Fill in your title to identify your position within the organization.

- Sign the form in the designated area to confirm the accuracy of the provided information.

- Enter the date of completion in the appropriate field.

- Provide your telephone number and email address for further communication if needed.

- Once all sections are filled out, you can save changes, download the form, print it, or share it as required.

Complete your WI A-006 form online to ensure accurate submission and compliance.

Related links form

What is a Certificate of Exempt Status (CES) number? A Certificate of Exempt Status (CES) number helps retailers identify organizations that qualify to make purchases exempt from Wisconsin sales and use tax. The Department of Revenue issues CES numbers to qualifying organizations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.