Loading

Get Canada 5010-r E 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada 5010-R E online

This guide provides a clear and supportive approach to completing the Canada 5010-R E form online. Whether you are new to digital document management or are looking for specific guidance, this resource will help streamline your filling process.

Follow the steps to accurately complete the Canada 5010-R E form

- Press the ‘Get Form’ button to access and open the Canada 5010-R E in your preferred editor.

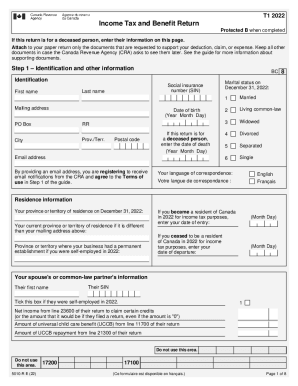

- Begin with Step 1, where you will enter your identification information. Fill in your social insurance number, last name, first name, and mailing address. Provide your date of birth and indicate if the return is for a deceased person by entering their date of death.

- In Step 2, focus on reporting your total income from all sources inside and outside Canada. Ensure you document all types of income, such as employment wages, pensions, and self-employment earnings.

- Proceed to Step 3 to determine your net income. Enter your total income and apply any deductions, such as RRSP contributions or business investment losses.

- In Step 5, calculate your federal tax based on your taxable income and apply any non-refundable tax credits. Ensure to reference the Federal Worksheet if necessary for accuracy.

- Once all sections are complete, you can save your changes, download the form, print it for your records, or share it as needed.

Complete your Canada 5010-R E online confidently by following these steps.

Related links form

If the CRA establishes your residence status as a Canadian resident, you'll pay income tax on income earned anywhere in the world. Even if you spend some time working outside Canada, you'll still be liable to pay federal and territorial tax. The amount of money you pay as a tax depends on what you earn.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.