Loading

Get Canada 5005-r E 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada 5005-R E online

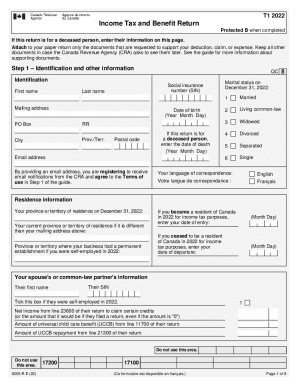

This guide provides clear instructions on how to fill out the Canada 5005-R E form online. Whether you are filing for yourself or for a deceased person, each step is designed to assist you in submitting your information accurately.

Follow the steps to complete your Canada 5005-R E form online.

- Press the ‘Get Form’ button to access the Canada 5005-R E form and open it in your document management system.

- Enter your identification details including your social insurance number (SIN), full name, mailing address, and date of birth in the designated fields. If applicable, include the date of death for a deceased person.

- Select your marital status as of December 31, 2022, and choose your preferred language for correspondence.

- If you became a resident of Canada during 2022, input your date of entry. Also, include the date you ceased to be a resident if that applies to you.

- Fill in your current province or territory of residence. If it differs from your mailing address, be sure to note this.

- Provide your spouse's or common-law partner's information if applicable, ensuring to include their SIN and net income details.

- Respond to queries regarding your Canadian citizenship and authorize the Canada Revenue Agency (CRA) to share your information with Elections Canada if desired.

- If applicable, indicate whether you have income exempt under the Indian Act by ticking the appropriate box.

- Disclose any foreign property ownership by selecting 'yes' or 'no' and completing Form T1135 if necessary.

- Move to Step 2 regarding total income, and accurately report your income from all sources, following the detailed line items provided.

- Continue to Steps 3 through 6, calculating your net income, taxable income, federal tax, and any balance owing or refunds.

- Once all sections are completed, review your entries for accuracy. You can then save your changes, download a copy of the form, print it for your records, or share it as needed.

Complete your documents online today for effective tax management.

Related links form

Non-Residents and Deemed Residents When a non-resident or deemed resident files a Canadian tax return, they are taxed at the current federal tax rates, plus a surtax of 48% of the federal tax, unless income was earned from a business with a permanent establishment in Canada.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.