Loading

Get Re: My Valid Canadian Hst/gst Number Is Not B...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Re: My Valid Canadian HST/GST Number Is Not B... online

This guide provides clear and concise instructions for filling out the Re: My Valid Canadian HST/GST Number Is Not B... form online. Follow these steps to ensure that you complete the form accurately and submit your objection effectively.

Follow the steps to complete your form successfully.

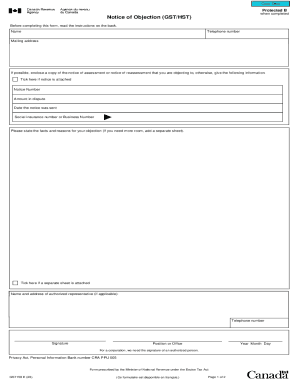

- Click ‘Get Form’ button to obtain the form and open it in your browser. This action will allow you to access the necessary document for completing your objection.

- Fill in your name as the applicant at the designated section. This identifies you as the person submitting the objection.

- Enter your telephone number in the appropriate field. Providing a contact number ensures that the Canada Revenue Agency can reach you if they have any questions regarding your submission.

- Provide your mailing address accurately. This is where they will send any correspondence related to your objection.

- If possible, check the box indicating that you are enclosing a copy of the notice of assessment or notice of reassessment. If you do not have it, make sure to fill out the required information regarding the notice.

- Input the notice number, the amount in dispute, and the date the notice was sent. These details are crucial for processing your objection.

- Fill out your social insurance number or business number in the designated space. This information is important for identification purposes.

- Clearly state the facts and reasons for your objection in the provided field. If you require additional space, check the box indicating that a separate sheet is attached and include it with your form.

- If you have an authorized representative, provide their name, address, and telephone number in the fields provided. This is optional and should only be filled in if applicable.

- Sign and date the form. For a corporation, ensure that the signature is from an authorized person. This confirms your submission of the objection.

- Once you have completed filling out the form, review all information for accuracy. You can then save the changes, download, print, or share the form as required.

Submit your objection online today to ensure your concerns are addressed promptly.

Related links form

The current rates are: 5% (GST) in Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Quebec, Saskatchewan, and Yukon. 13% (HST) in Ontario. 15% (HST) in New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.