Loading

Get How Do I File A Final Return For Someone Who Has Passed Away?

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How Do I File A Final Return For Someone Who Has Passed Away? online

Filing a final return for someone who has passed away can feel overwhelming, but it is an important task that must be handled with care. This guide provides clear, step-by-step instructions to help you navigate the online filing process with ease and confidence.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to access the form and open it in your editor.

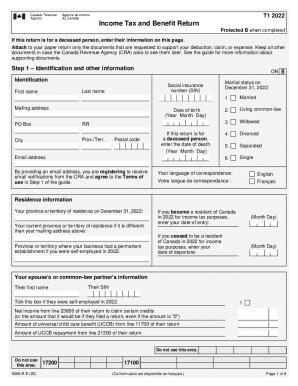

- Begin by entering the identification information of the deceased, including their social insurance number, last name, first name, mailing address, date of birth, and date of death.

- Indicate the marital status of the deceased on December 31, 2022, by selecting the appropriate option from the provided list.

- Fill in any applicable residence information, including the province or territory of residence as of December 31, 2022, and any changes if the deceased had a different mailing address.

- If the deceased had a spouse or common-law partner, enter their information along with any necessary financial details, such as net income and amounts related to child care benefits.

- In the total income section, report income from all sources, such as employment income, pensions, and any other relevant financial information.

- Proceed to the net income section and apply deductions accordingly to calculate the final amount.

- Calculate the taxable income and federal tax based on the provided amounts and credits, detailing any further specifics as required.

- Conclude by reviewing the refund or balance owing section, and ensure all amounts are accurately reflected.

- Finally, save your changes, and download, print, or share the completed form as necessary.

Complete the final return filing process online to ensure that everything is in order.

Use Form 1310 to claim a refund on behalf of a deceased taxpayer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.