Loading

Get Income Tax And Benefit Return For Non-residents And ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

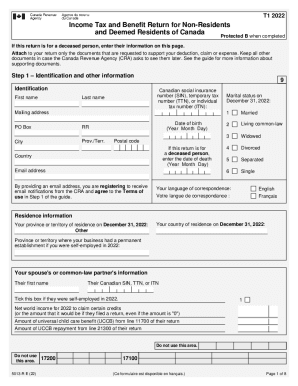

How to fill out the Income Tax and Benefit Return for Non-residents online

Navigating the Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada can seem daunting. This guide provides clear and comprehensive instructions to help you complete the form online with confidence.

Follow the steps to fill out your form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in your identification information, including your first name, last name, Canadian social insurance number, mailing address, and date of birth. Ensure that all fields are accurate and complete.

- Provide your marital status as of December 31, 2022, and include any relevant information about your spouse or common-law partner as needed.

- In the elections Canada section, indicate whether you have Canadian citizenship and if you authorize the CRA to share your information for electoral purposes.

- Tick the box if you have income exempt under the Indian Act and complete any required additional forms.

- Identify your residency status on December 31, 2022, by selecting the appropriate option that best describes your situation.

- Report your total income by accurately filling in the various fields under 'Step 2 - Total income,' including employment income, benefits, and other sources of income.

- Calculate your net income by following the instructions in 'Step 3 - Net income,' ensuring all necessary deductions are accurately applied.

- Complete 'Step 4 - Taxable income' by entering amounts as required, making sure to subtract any applicable deductions.

- Proceed to 'Step 5 - Federal tax' and carefully calculate your federal tax based on your taxable income while applying any non-refundable tax credits.

- Finally, fill in 'Step 6 - Refund or balance owing.' Check all calculations and make sure you enter the correct amounts for potential refunds or balance owed. Save your changes, download, or print the completed form for your records.

Complete your Income Tax and Benefit Return for Non-residents online today and ensure all your information is submitted correctly.

Who Must File. You must file a return if you are a nonresident alien engaged or considered to be engaged in a trade or business in the United States during the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.