Loading

Get Mo Mo-1120v 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-1120V online

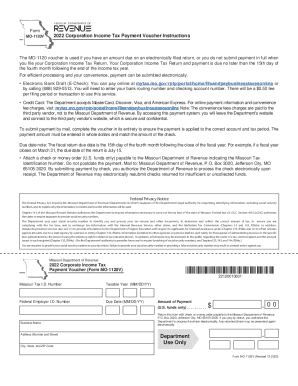

Filling out the MO MO-1120V is an essential step for corporations needing to submit their income tax payment. This guide provides step-by-step instructions on completing the form accurately and efficiently, ensuring timely processing.

Follow the steps to complete the MO MO-1120V online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your Missouri Tax Identification Number in the designated field to ensure the payment is applied to the correct account.

- Provide the Taxable Year in the format MM/DD/YY to indicate the period for which you are filing.

- Input your Federal Employer Identification Number in the specified section, confirming your business identity.

- Specify the Due Date in the format MM/DD/YY, ensuring it aligns with the deadline for your fiscal year.

- Indicate the Amount of Payment in whole dollars, matching the actual payment you intend to submit.

- Complete the Business Name and Address fields, including the number, street, city, state, and ZIP code to provide clear contact details.

- Once you have filled out all fields accurately, you can save changes, download, print, or share the completed form.

Complete your MO MO-1120V online today and ensure your corporation's tax obligations are met promptly.

For 2023, the first $1,000 of income is tax-exempt. The top tax rate is also reduced from 5.3% to 4.95% (on more than $8,968 of taxable income). (Note: Kansas City and St. Louis also impose an earnings tax.) Missouri State Tax Guide - Kiplinger kiplinger.com https://.kiplinger.com › state-by-state-guide-taxes kiplinger.com https://.kiplinger.com › state-by-state-guide-taxes

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.