Get Mo Mo-1120v 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-1120V online

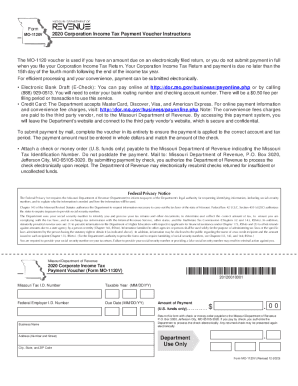

This guide provides comprehensive instructions for completing the MO MO-1120V, a voucher for Corporation Income Tax payments in Missouri. By following these steps, you can ensure that your form is filled out correctly and submitted efficiently.

Follow the steps to complete the MO MO-1120V online

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Enter your Missouri Tax Identification Number in the designated field. This number identifies your business within state tax records.

- Fill in the Taxable Year by entering the appropriate dates in MM/DD/YY format. This indicates the tax period for which you are making the payment.

- Provide your Federal Employer Identification Number (EIN). This helps to identify your business for federal tax purposes.

- Indicate the Due Date by entering the corresponding date in MM/DD/YY format. This is the deadline for your Corporation Income Tax payment.

- In the Amount of Payment field, enter the total payment due in whole dollars. Ensure this amount matches the check or money order if paying by mail.

- Write your Business Name and the Address (including Number and Street, City, State, and ZIP Code) in the provided fields.

- Review all the information entered to ensure accuracy. This will help prevent processing delays or errors.

- Once completed, you can save the changes. Additionally, you may choose to download, print, or share the form as needed for your records.

Complete your Corporation Income Tax payment voucher online for a hassle-free experience.

Related links form

4.0 percent Missouri has a 4.0 percent corporate income tax rate. Missouri has a 4.225 percent state sales tax rate, a max local sales tax rate of 5.763 percent, an average combined state and local sales tax rate of 8.33 percent. Missouri's tax system ranks 11th overall on our 2023 State Business Tax Climate Index. Missouri Tax Rates & Rankings taxfoundation.org https://taxfoundation.org › location › missouri taxfoundation.org https://taxfoundation.org › location › missouri

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.