- US Legal Forms

- Form Library

- More Forms

- More Multi-State Forms

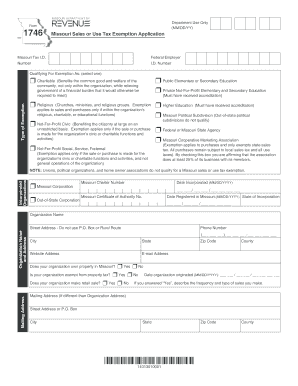

- MO 1746 2019

Get MO 1746 2019-2024

Ication. Submit all required information to avoid a delay or denial of your exemption letter. Federal or Missouri state agencies, Missouri political subdivisions, elementary and secondary schools operated at public expense, or schools of higher education are not required to furnish the documents below (see instructions). Application - A fully completed and signed Missouri Sales or Use Tax Exemption Application (Form 1746) Determination of Exemption - A copy of IRS determination of exe.

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Exempts FAQ

-

The non-reusable items of tangible personal property furnished in hotels and motels are not subject to sales tax. Non-reusable items include (but are not limited to) soap, shampoo, tissue, other toiletries, food, or confectionery items.

-

A Tax Waiver can normally only be obtained in person at the Assessor's Office. In light of the COVID-19 emergency, the Assessor's Office has implemented a procedure to request it online.

-

Any social, civic, religious, political subdivision or educational organization can apply for a sales tax exemption by completing Form 1746 Document, Missouri Sales Tax Exemption Application. This form lists the information needed to verify the organization is indeed a tax-exempt non-profit organization.

-

Do you have economic nexus in Missouri? Under Missouri's economic nexus law, retailers who make at least $100,000 of retail sales to buyers in the state in the previous 12-month period must collect sales tax from Missouri buyers. This law is similar to the economic nexus provisions found in many other states.

Affirming Related content

-

1746 - Missouri Sales or Use Tax Exemption...

Out of state organizations applying for a Missouri exemption letter must provide a copy of...

Learn more -

1746 Missouri Sales or Use Tax Exemption...

APPLICATION - A fully completed and signed Missouri Sales or Use Tax Exemption Application...

Learn more -

Map Address

1746 North Buchanan. City: Moberly, MO. Zip: 65270. County: Randolph. More ... MOBERLY, MO...

Learn more -

Map Address

1746 CHASE DR City,State: FENTON, MO County: St Louis Zip: 63026. Zoom to. +. –. 100m...

Learn more -

Mason Road Resurfacing and Multi-Use Trail...

The project includes standard pavement repairs, curb ramp replacements and a full signal...

Learn more -

H.R.1746 - Predisaster Hazard Mitigation Act of...

Predisaster Hazard Mitigation Act of 2010 - Amends the Robert T. Stafford Disaster Relief...

Learn more -

Nutrition education in Missouri schools

by G Gates · 1994 · Cited by 6 — Dept. of Food Science and Human Nutrition, University...

Learn more -

Earnings Tax Refund | News Releases

Jun 1, 2023 — Kansas City, MO 64106 816-513-1313. View City Hall hours and holidays. We...

Learn more -

ZipCode Lookup

1746 to 1746, Ann Wagner, Missouri 2nd, 2350 Rayburn, 51621. 1894 to 1899, Ann Wagner...

Learn more -

2008.03.05 CR1746 Community Alternatives Missouri...

Mar 5, 2008 — CR1746. DECISION. Petitioner, Community Alternatives Missouri, Inc., d/b/a...

Learn more -

1746-UM010, Barrel Temperature Control Module User...

The 1746-BTM module is compatible with any SLC processor that supports M0/M1 files, such...

Learn more -

Existing U.S. Coal Plants - Global Energy Monitor...

May 5, 2021 — MO, Lake Road Generating Station (MO) · Kansas City Power & Light, 1...

Learn more -

Site Remediation Program Monitored Natural...

Mar 1, 2012 — Environmental Science & Technology, Vol.38(60:1746-1752. Fetter C. W. 1994...

Learn more -

EAU Guidelines on Sexual and Reproductive Health

... mo). 617. 31% (lifetime). 618. 1999. Laumann et al. (NHSLS) [197]. Interview. NA...

Learn more -

Chemical Reduction (In Situ - ISCR)

Apr 28, 2022 — ... M.O., 2001. Reductive Dechlorination of Trichloroethylene and Carbon...

Learn more -

Untitled

... 1746 /H [ 4067 3754 ] /L 5171924 /E 207650 /N 64 /T 5136984 endobj xref 1741 ... mo}^2...

Learn more -

Biogeochemical Transformation Handbook

by BT HANDBOOK · 2015 — 1746-1752. Gillham, R.W. and S.F. O'Hannesin. 1994. “Enhanced...

Learn more -

1746 Qatari Rials to Sri Lankan Rupees Converter |...

1746 Qatari Rials to Sri Lankan Rupees conversion on the fly. No need to click ... MO...

Learn more -

How to Obtain Tax Exempt Status

File a Missouri Sales/Use Tax Exemption Application, http://dor.mo.gov/forms/1746.pdf, and...

Learn more -

MZ-N10 Service Manual

by PM RECORDER — This set provides the Overall adjustment mode that allows CD and MO...

Learn more -

Missouri Sales/Use Tax Exemption Application

Aug 28, 2013 — If a sales/use tax exemption letter is still needed, sign page two of...

Learn more -

1746 Kuwaiti Dinars to Turkish Lira Converter |...

1746 Kuwaiti Dinars to Turkish Lira conversion on the fly. No need to click ... MO...

Learn more -

1995

Dec 18, 1995 — Form 1746-Missouri Sales/Use Tax Exemption Application. Instructions...

Learn more -

Federal Perjury Materials

(2) in any declaration, certificate, verification, or statement under penalty of perjury...

Learn more -

Helping Your Client Create and Grow a Successful...

by DM Malkus · 2011 · Cited by 2 — 31 See Instructions for Form MO-1120...

Learn more -

Index of /ColCoin/ColCoinImages/Sp-milled-1

Index of /ColCoin/ColCoinImages/Sp-milled-1 ; [IMG] · [IMG] ; Sp-1R-Mo-1746.obv.sm.jpg ·...

Learn more -

PB1746 A Landowner's Guide to Native Warm-Season...

PLS is calculated as follows: Seed: Indiangrass (Osage). Pure seed: 67.62%. Germination:...

Learn more -

Recent HYDROLOGIC STATEMENT's from KKRF

NWS...MISSOURI BASIN RIVER FORECAST CENTER PLEASANT HILL MO 151313 Z 10/23 ... 1746Z FRI...

Learn more -

Claude Mouton

Claude Mouton. 1746. Claude Mouton was a surgeon and dentist in Paris at a time when...

Learn more -

St. Louis Area Archives and Special Collections

Dec 4, 2023 — E-mail archrefstl@sos.mo.gov or call 314-588-1746 before visiting. St...

Learn more -

1746 Missouri Sales or Use Tax Exemption...

Application - A fully completed and signed Missouri Sales or Use Tax Exemption Application...

Learn more -

Sales/Use Tax Forms - Forms and Manuals - MO.gov

1746PDF Document, Missouri Sales or Use Tax Exemption Application, 9/1/2022. 1749E...

Learn more -

Federal Register/Vol. 84, No. 138/Thursday, July...

Jul 18, 2019 — 1746, in the following format: If executed within the United States...

Learn more -

NATIONAL DEFENSE AUTHORIZATION ACT FOR FISCAL ...

Dec 20, 2019 — Prohibition on use of funds for reduction of aircraft carrier force...

Learn more -

RULES Supreme Court of the United States

Apr 18, 2019 — § 1746) in the form prescribed by the Federal Rules of Appel- late...

Learn more -

Wage Index

Oct 2, 2023 — CMS-1765-P Wage Index Tables for FY 2023 - Proposed (ZIP) · CMS-1746-F...

Learn more -

Free Tax Preparation | News Releases

Form W-2 for every job you or your spouse worked in 2019, 1099's for security disability...

Learn more -

2019 Instructions for Schedule A (Rev. January...

Jan 16, 2020 — Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions...

Learn more -

CONTRA COSTA COUNTY - 2019 Employee Benefits

Oct 15, 2018 — Services Unit at 925-335-1746 or send your questions to...

Learn more -

Surviving sepsis campaign: international...

Clin Infect Dis 54(12):1739–1746. 168. Magill SS, Edwards JR, Bamberg W et al...

Learn more -

H.R.1746 - Predisaster Hazard Mitigation Act of...

Predisaster Hazard Mitigation Act of 2010 - Amends the Robert T. Stafford Disaster Relief...

Learn more -

EAU Guidelines on Sexual and Reproductive Health

... mo). 617. 31% (lifetime). 618. 1999. Laumann et al. (NHSLS) [197]. Interview. NA...

Learn more -

Existing U.S. Coal Plants - Global Energy Monitor...

May 5, 2021 — MO, Lake Road Generating Station (MO) · Kansas City Power & Light, 1...

Learn more -

Untitled

... MO KAW\ j(Qm \g2OH?[ zVh( ]7=K FGi C $j&z nNm9 w8Er ,l ; ZQ,F> jS2P= H:GfN x ... 1746...

Learn more -

모하메드 살라 (r1746 판)

이집트의 축구 선수로 현재 리버풀 FC에서 뛰고 있으며 현재는...

Learn more -

태민 (r1746 판)

2019년 2월, 미니 2집 'WANT'로 컴백했다. 3월, 서울 올림픽공원...

Learn more -

2019 Tajski baht za Egiptovskih funtov - THB za...

Pretvorba 2019 Tajski baht v Egiptovskih funtov sproti. Ni vam treba ... 1,746.62 EGP. 0%;...

Learn more -

Távolság Cheswick (Pennsylvania) - frwiki.wiki

1,746, ▽ −8.06%. Is. 2017, 1,703, ▽ −2.46%. Hivatkozások. ↑ (in) " Cheswick...

Learn more -

Warson erdőben - frwiki.wiki

1,746, △ + 230,06%. 1970, 2,544, △ + 45,7%. 1980, 2 127, ▽ −16,39%. 1990, 2,049...

Learn more -

1808 bower

... 1746, at birth place, Pennsylvania, to Hans Jacob (Jacob) Schaub and ... The Rent...

Learn more -

Sales Tax Matrix - Notes and Assumptions

A Missouri Form 1746 must be completed to generate a Missouri Exemption Certificate. 7...

Learn more -

DoD Vapor Intrusion Handbook

Jan 15, 2009 — MEMORANDUM FOR DEPUTY ASSISTANT SECRETARY OF THE ARMY. (ENVIRONMENT...

Learn more -

Institutional Information - Research and Project...

Identifying Information. Princeton. Establishment Date: October 12, 1746. State. County...

Learn more -

Site Remediation Program Monitored Natural...

Mar 1, 2012 — Environmental Science & Technology, Vol.38(60:1746-1752. Fetter...

Learn more -

SF85P QUESTIONNAIRE FOR PUBLIC TRUST POSITIONS

This form is a permanent document that may be used as the basis for future investigations...

Learn more -

Framework for Site Characterization for Monitored...

This document focuses on characterization of sites where MNA is being considered for re...

Learn more -

Standard Form 86 - Questionnaire for National...

This form may become a permanent document that may be used as the basis for future...

Learn more -

EAU Guidelines on Sexual and Reproductive Health

... [1746]. Worsening semen parameters are associated with a higher grade of ... Mo, M.Q...

Learn more -

EAU-Guidelines-on-Paediatric-Urology-2022.pdf...

THE GUIDELINE. 11. 3.1. Phimosis. 11. 3.1.1 Epidemiology, aetiology and pathophysiology...

Learn more -

12-month Enrollment 2019-20

Oct 29, 2019 — 1,746. Doctor's - professional practice student FTE. 175. 172. Total FTE...

Learn more -

The Surgical Infection Society Revised Guidelines...

by JE Mazuski · 2017 · Cited by 518 — Summary: The current recommendations of the SIS...

Learn more -

EAU Guidelines on Sexual and Reproductive Health

... form of hypogonadism, characterised by normal serum levels and ... 2019: e13298...

Learn more -

AGENDA COMMITTEE ON AUDIT Meeting

Mar 19, 2019 — in fiscal year 2019-20, which is reflected in the 2019 audit plan....

Learn more -

Existing U.S. Coal Plants - Global Energy Monitor...

May 5, 2021 — Lake Road Generating Station (MO) · Kansas City Power & Light, 1, 1966...

Learn more -

Existing U.S. Coal Plants - Global Energy Monitor...

May 5, 2021 — Lake Road Generating Station (MO) · Kansas City Power & Light, 1, 1966...

Learn more -

Work-Study Rehire Packet

(Mo./Day/Yr.) (Mo./Day/Yr.) To be completed by hiring supervisor: Job ... Documents or the...

Learn more -

1746 Kuwaiti Dinars to Turkish Lira Converter |...

1 Kuwaiti Dinar = 92.62378 Turkish Lira · KWD/TRY exchange rate in the last 90 days ·...

Learn more -

Testimonial letters

Nov 26, 2023 — This page is the central ("master") page for an amazing collection of...

Learn more -

SUMMARY JUDGMENTS IN TEXAS

INTRODUCTION...

Learn more -

Cell Reports - fatcat.wiki

... Mo, Marek Kimmel, Katherine Y. King. 2016 | Cell Reports · doi:10.1016/j.celrep...

Learn more -

Pierre de Rigaud de Vaudreuil - frwiki.wiki

... 1746, en konflikt mellom Vaudreuil og Soulier Rouge , lederen for en chacta ... form...

Learn more -

ATTACKING INNOVATION

by XT NGUYEN · Cited by 20 — ABSTRACT. Economists generally agree that innovation is...

Learn more -

MZ-N10 Service Manual

by PM RECORDER — This set provides the Overall adjustment mode that allows CD and MO...

Learn more -

H-1B Petition Instructions to Departments &...

“Pursuant to 28 USC 1746, I declare under penalty of perjury that the information...

Learn more -

How to Obtain Tax Exempt Status

File a Missouri Sales/Use Tax Exemption Application, http://dor.mo.gov/forms/1746.pdf, and...

Learn more -

Missouri Sales/Use Tax Exemption Application

Aug 28, 2013 — If a sales/use tax exemption letter is still needed, sign page two of...

Learn more -

1995

Dec 18, 1995 — Form 1746-Missouri Sales/Use Tax Exemption Application. Instructions for...

Learn more -

Helping Your Client Create and Grow a Successful...

by DM Malkus · 2011 · Cited by 2 — 31 See Instructions for Form MO-1120...

Learn more -

Sales Tax Matrix - Notes and Assumptions

A Missouri Form 1746 must be completed to generate a Missouri Exemption Certificate. 7...

Learn more -

APR 2 7 2023

Feb 7, 2023 — (i) USNAINST 1746.lB CH-1 ... An originator is the person who initiates a...

Learn more -

RadSafe 2b

RPD Authorized User: Registration No.: 1746 846 ... ☐ Q.E. Summary form filed with UMKC...

Learn more -

SF85P QUESTIONNAIRE FOR PUBLIC TRUST POSITIONS

This form is a permanent document that may be used as the basis for future investigations...

Learn more -

radiation-application-for-possession-and-use-of-radsafe...

HUMAN USE: (MO 1746). ____Bone Densitometer (DEXA unit) Research. Dental ... Credit Card:...

Learn more -

1746 Missouri Sales or Use Tax Exemption...

1746 Missouri Sales or Use Tax Exemption Application. Department Use Only. (MM ... Form...

Learn more -

Sales/Use Tax Forms - Forms and Manuals - MO.gov

1746PDF Document, Missouri Sales or Use Tax Exemption Application, 9/1/2022 ... 11/7/2019...

Learn more -

Safe Haven for Transgender residents | News...

May 11, 2023 — In 2019, the City Council banned conversion therapy and “reparative...

Learn more -

H.R.1746 - Predisaster Hazard Mitigation Act of...

Predisaster Hazard Mitigation Act of 2010 - Amends the Robert T. Stafford Disaster Relief...

Learn more -

Recorded Votes

May 08, 2019, General File, AM 1329 Appropriations AM 1667 Friesen, 42-0-6, View ... AM...

Learn more -

Wage Index

Oct 2, 2023 — CMS-1765-P Wage Index Tables for FY 2023 - Proposed (ZIP) · CMS-1746-F...

Learn more -

Trends in and Characteristics of Drug Overdose...

by J O’Donnell · 2021 · Cited by 128 — This report describes drug overdose deaths...

Learn more -

2019 Instructions for Schedule A (Rev. January...

Jan 16, 2020 — Did you live in Alaska, Arizona, Arkansas, Colorado, Georgia, Illinois...

Learn more -

2019 Seattle Daylight Low Tides - Puget Sound...

1746. 0.4 SU no daylight low. TU. 0842. 3.4 FR. 0944. -0.8 SU. 1002. -1.6 WE. 1102. -0.9...

Learn more -

Sexual Assault Kit Totals

Sexual Assault Kits Tested: Year. 2018. 2019. 2020. 2021. 2022. 2023. Totals. 680. 780...

Learn more -

Mizzou releases fall 2019 graduation list

Feb 27, 2020 — In December 2019, 1,746 students received degrees. The graduation list...

Learn more -

Sales Tax Matrix - Notes and Assumptions

A Missouri Form 1746 must be completed to generate a Missouri Exemption Certificate. 7...

Learn more -

Institutional Information - Research and Project...

Identifying Information. Princeton. Establishment Date: October 12, 1746. State. County...

Learn more -

SF85P QUESTIONNAIRE FOR PUBLIC TRUST POSITIONS

This form will be used by the United States (U.S.) Government in conducting background...

Learn more -

"Evaluations of Multiple Non-Destructive...

by A Alhaj · 2019 — ... 1746 · Civil, Architectural and Environmental Engineering...

Learn more -

Seema Sheth | Plant and Microbial Biology - NC...

University of Missouri, St. Louis ... Additive genetic variance for lifetime fitness and...

Learn more -

Data-Driven Analytics to Discover APRN's Impact on...

by K Lee · 2023 — Setting and Participants: Residents of NHs participating in the...

Learn more -

"Learning through Mobile Devices: Leveraging...

by B Eschenbrenner · 2019 · Cited by 18 — Eschenbrenner, B., & Nah, F. F. (2019)...

Learn more -

AGENDA COMMITTEE ON AUDIT Meeting

Mar 19, 2019 — in fiscal year 2019-20, which is reflected in the 2019 audit plan....

Learn more -

NTSB Aircraft Accident Reports (AAR) - Hunt...

NTSB/AAR-21-02 - Collision with Terrain During Takeoff of Parachute Jump Flight, Beech...

Learn more -

1746 - Missouri Sales or Use Tax Exemption...

Application - A fully completed and signed Missouri Sales or Use Tax Exemption Application...

Learn more -

1746 Missouri Sales or Use Tax Exemption...

APPLICATION - A fully completed and signed Missouri Sales or Use Tax Exemption Application...

Learn more -

Important Earnings Tax Update | News Releases

Mar 3, 2023 — The City of Kansas City, Missouri, has changed the process for a taxpayer...

Learn more -

Chart Showing States That Have Enacted Statutes...

Oct 29, 2005 — 28 U.S.C. § 1746. Unsworn declarations under penalty of perjury ... (a)...

Learn more -

H.R.1746 - Predisaster Hazard Mitigation Act of...

Predisaster Hazard Mitigation Act of 2010 - Amends the Robert T. Stafford Disaster Relief...

Learn more -

Mason Road Resurfacing and Multi-Use Trail...

This project provides for the resurfacing of Mason Road from Clayton Road to the end of...

Learn more -

Carcinogenesis 2,3,7,8-Tetrachlorodibenzo-p-dioxin...

Louis, MO) were prepared every 3 months. The 10 //g/ml primary stock solution was further...

Learn more -

2022 Instructions for Schedule A (2022)

Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal...

Learn more -

~~southwest technologies inc. - accessdata.fda.gov

matrix in the form of a continuous sheet withi`plasticizer of gcnehnyanid-water. ... 1746...

Learn more

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to MO 1746

- agencys

- yy

- outofstate

- salestaxexemptionsdor

- subdivisions

- revocation

- exempts

- affirming

- MISREPRESENTATION

- exemptions

- tty

- ministries

- accreditation

- benefiting

- abbreviations

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.