Loading

Get Irs 943-x 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 943-X online

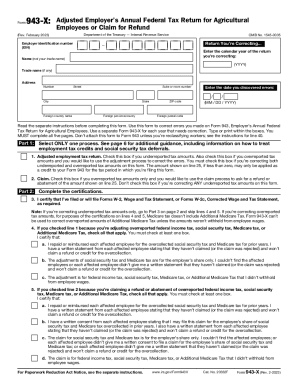

The IRS 943-X form is used to adjust the Employer's Annual Federal Tax Return for Agricultural Employees or to claim a refund for overreported taxes. This guide provides clear, step-by-step instructions on how to complete the form online effectively and accurately.

Follow the steps to fill out the IRS 943-X online.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Fill in your Employer Identification Number (EIN) at the top of the form. This number is crucial for identifying your business.

- Enter the calendar year of the return you are correcting in the designated field. Ensure this is the correct year as it impacts your reporting.

- Provide your name (not your trade name) and any applicable trade name under which you are doing business.

- Complete your address details, including street number, city, state, and ZIP code. Include any foreign country details if applicable.

- Document the date you discovered the errors using the format MM/DD/YYYY.

- In Part 1, select the process you are using for correction by checking either the box for 'Adjusted employment tax return' or 'Claim' based on whether you are correcting underreported and/or overreported tax amounts.

- Proceed to Part 2 and complete the certifications by marking the appropriate boxes based on your corrections.

- In Part 3, enter the corrections for the calendar year. You will need to fill out various columns capturing corrected amounts, originally reported figures, and the differences.

- If certain lines do not apply to your circumstances, leave them blank. Make sure you accurately calculate the amounts and indicate any adjustments.

- Move to Part 4 to provide a detailed explanation of your corrections. This section should outline how you arrived at the adjustments.

- Finally, complete Part 5 by signing the form, entering your name, title, and providing the date. Ensure that all five pages of the form are completed before submission.

- Once you have reviewed all information and ensured accuracy, you can save changes, download, print, or share the completed form as needed.

Start filling out the IRS 943-X online today to ensure your tax corrections are made promptly.

Mailing Addresses for Forms 943 Mail return without payment...Mail return with payment...Internal Revenue Service P.O. Box 409101 Ogden, UT 84409Internal Revenue Service P.O. Box 932200 Louisville, KY 40293-22003 more rows • Jun 13, 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.