Loading

Get 1994 Inst 8810. Instructions For Form 8810

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1994 Inst 8810. Instructions for Form 8810 online

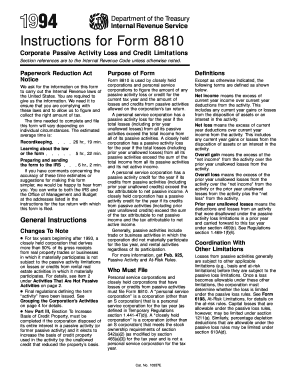

This guide provides a clear and systematic approach to filling out the 1994 Inst 8810. Instructions for Form 8810, which assists closely held corporations and personal service corporations in calculating their passive activity losses and credits for the tax year.

Follow the steps to accurately complete Form 8810.

- Press the ‘Get Form’ button to access and open the 1994 Inst 8810 form in your browser or a suitable editor.

- Begin by reviewing the instructions on the first page, including the purpose of the form, to understand how your passive activity losses and credits are determined.

- Identify whether your corporation qualifies as a closely held corporation or personal service corporation, as this affects how you fill out the form.

- Complete Part I by entering the total income and losses from passive activities, using Worksheets 1 and 2 as necessary for calculations.

- Fill out Part II to determine the passive activity credits for the current year, using Worksheet 5 to help track your calculations.

- If applicable, complete Part III to elect to increase the basis of credit property, ensuring to follow the instructions for dispositions.

- Review the entire form for accuracy and completeness before saving your changes.

- Finally, download, print, or share the completed Form 8810 based on your filing requirements.

Take action now and fill out your Form 8810 online to ensure compliance with tax regulations.

Personal service corporations and closely held corporations use Form 8810 to figure the amount of any passive activity loss (PAL) or credit for the current tax year and the amount of losses and credits from passive activities allowed on the corporation's tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.