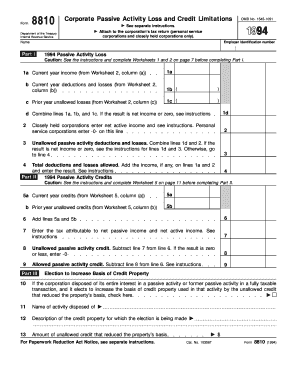

Get 1545-1091 Department Of The Treasury Internal Revenue Service Name Employer Identification Number

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1545-1091 Department Of The Treasury Internal Revenue Service Name Employer Identification Number online

Filling out the 1545-1091 Department of the Treasury Internal Revenue Service Name Employer Identification Number form is an essential part of managing tax obligations for corporations. This guide offers clear, step-by-step instructions to complete the form online effectively.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the corporation in the designated field, ensuring that it matches the official registered name.

- Input the employer identification number accurately to avoid processing delays.

- Complete Part I by entering current year income, current year deductions, and prior year unallowed losses from the respective worksheets.

- Combine the entries from lines 1a, 1b, and 1c to determine net income or losses.

- Proceed to line 2 and enter unallowed passive activity deductions and losses as directed.

- Move to line 4 to calculate and enter total deductions and losses allowed.

- In Part II, follow similar instructions for credits by entering current year credits and prior year unallowed credits.

- Complete lines related to tax attributable to net passive income and net active income as specified.

- Navigate to Part III if applicable, to elect to increase the basis of credit property by following line instructions.

- Review all entries for accuracy and clarity, making any necessary adjustments.

- Once completed, save changes, download, print, or share the form as needed.

Start filling out your documents online today to ensure timely compliance!

EIN. An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify a business entity. It is also used by estates and trusts which have income which is required to be reported on Form 1041, U.S. Income Tax Return for Estates and Trusts. Taxpayer Identification Numbers (TIN) | Internal Revenue Service irs.gov https://.irs.gov › individuals › international-taxpayers irs.gov https://.irs.gov › individuals › international-taxpayers

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.