Loading

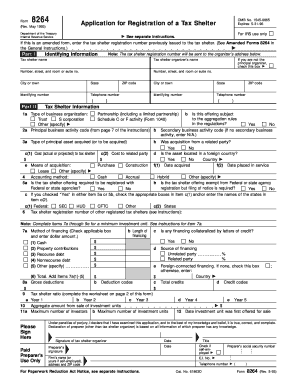

Get Form 8264. Application For Registration Of A Tax Shelter

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8264. Application For Registration Of A Tax Shelter online

Filling out the Form 8264 is an essential step for individuals and organizations seeking to register a tax shelter. This guide provides clear, step-by-step instructions tailored to users of all experience levels, ensuring a smooth online filing process.

Follow the steps to complete the form accurately and efficiently.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Begin with Part I: Identifying Information. Fill in the tax shelter name, organizer's name, street address, city, state, identifying number, and telephone number.

- Move to Part II: Tax Shelter Information. Indicate the type of business organization by checking the appropriate box. Provide details on whether the offering is subject to aggregation rules.

- Continue in Part II by entering the principal and secondary business activity codes as instructed. Specify the type of principal asset acquired, whether the acquisition is from a related party, and the associated costs.

- Detail the method of acquisition and the relevant accounting method, selecting from cash, accrual, or hybrid options.

- Address whether the tax shelter offering needs to be registered with federal or state agencies; provide additional details as required.

- Provide information on financing methods, including cash contributions and types of debt. Record gross deductions and any financing collateralizations.

- Finish the form with the signature of the tax shelter organizer and the preparer if applicable. Ensure all required fields are completed before saving your changes.

- Once completed, download, print, or share the finalized form and confirm all data is accurate.

Complete your Form 8264 online to ensure seamless registration of your tax shelter.

While there are plenty of completely legitimate and credible forms of tax shelters, many individuals and tax scammers use tax shelters to illegally lower their tax liability. Any tax shelter that is used solely for the purpose of lowering tax liability is considered abusive.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.