Loading

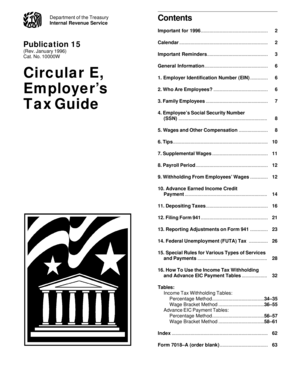

Get Department Of The Treasury Internal Revenue Service Contents Important For 1996

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Department Of The Treasury Internal Revenue Service Contents Important For 1996 online

This guide provides a detailed overview of the steps required to fill out the Department Of The Treasury Internal Revenue Service Contents Important For 1996. It aims to assist users of all experience levels in accurately completing the form online.

Follow the steps to fill out the document effectively.

- Click 'Get Form' button to obtain the form and open it in an online editor.

- Begin with the 'Employer Identification Number (EIN)' section. Enter your unique nine-digit EIN, ensuring you follow the correct format (00-0000000). If you do not have an EIN, request one using Form SS-4.

- Proceed to the section labeled 'Who Are Employees?'. This requires you to identify who qualifies as an employee under common law and to ensure you understand the legal implications.

- Fill in the 'Family Employees' section. Note the specific guidelines applicable to family members and their employment classification.

- Provide the 'Employee’s Social Security Number (SSN)'. It's important to verify that the name and SSN match the employee's social security card to avoid penalties.

- Complete the 'Wages and Other Compensation' section. This includes all forms of pay such as bonuses and commissions. Ensure you understand the definitions and exclusions as provided in the form.

- Fill out the sections related to 'Tips', 'Supplemental Wages', and 'Payroll Period' as they apply to your business.

- Review withholding requirements. Navigate to the section about 'Withholding From Employees’ Wages' to correctly withhold income tax based on the completed Form W-4.

- Finalize the document by saving your changes. Choose to download, print, or share the completed form according to your needs.

Complete your documents online to ensure compliance and streamline your filing process.

The Internal Revenue Service is a federal agency responsible for collecting federal taxes and enforcing U.S. tax laws. Most of the work of the IRS involves individual and corporate income taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.