Loading

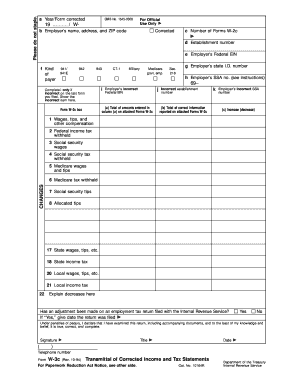

Get Form W-3c. Transmittal Of Corrected Wage And Tax Statements

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-3C. Transmittal Of Corrected Wage And Tax Statements online

Filling out the Form W-3C is essential for employers correcting wage and tax information submitted to the Social Security Administration. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the Form W-3C correctly.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- In box a, enter the year and type of form you are correcting. For example, use '93/2' for all Forms W-2 being corrected for 1993.

- In box b, enter your employer's name, address, and ZIP code as it appears on the Forms 941, 942, or 943. If you are correcting this information, check the corrected box.

- In box c, indicate the number of Forms W-2c you are submitting with this form, or enter -0- if correcting a previously filed Form W-3.

- In box d, you may leave blank unless identifying multiple establishments; then, enter the establishment number.

- In box e, enter your Federal Employer Identification Number (EIN) as assigned by the IRS.

- In box f, select the appropriate box to indicate the kind of payer you are, such as 941 for quarterly tax filers.

- You may skip box g, the state ID number, unless necessary for state returns.

- In box h, enter the SSA number if you are a state or local government employer with a special agreement with SSA.

- In box i, enter the employer’s incorrect Federal EIN only if it was incorrect on the last form filed.

- For issues in boxes j and k, document the incorrect establishment number and incorrect SSA number as necessary.

- For boxes 1 through 8, input the corrected totals from the relevant Forms W-2c.

- If adjusting amounts, enter any changes in the corresponding boxes, marking decreases with parentheses.

- Box 22 is required if there are any decreases in taxable amounts; provide an explanation for these changes.

- Review the completed form for accuracy, then save changes, download, print, or share the form as needed.

Complete your forms online efficiently today!

IRS Form W-2, also known as a “Wage and Tax Statement,” reports an employee's income from the prior year and how much tax the employer withheld. Employers send out W-2s to employees in January.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.