Loading

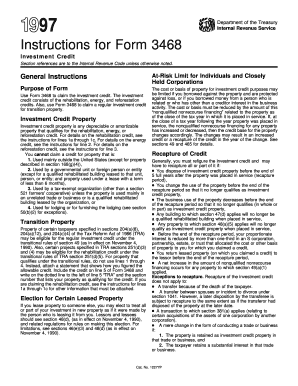

Get 1997 Instructions For Form 3468 Investment Credit Section References Are To The Internal Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1997 instructions for form 3468 investment credit section references are to the internal revenue online

Filing form 3468 for the investment credit can be straightforward with the right guidance. This document provides detailed instructions on how to successfully complete and submit the form online, ensuring you can claim any investment credits available to you.

Follow the steps to complete the investment credit form effectively

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the general instructions to understand the purpose of the form and the types of properties that qualify for the investment credit. Ensure you have accurate information regarding the cost or basis of the property.

- Complete Part I by entering the relevant information for the current year credit, including lines 1a through 1c for the rehabilitation credit, line 2 for the energy credit, and line 3 for the reforestation credit. Attach any required statements to support your claims.

- If applicable, report any credit from cooperatives on line 4, ensuring that you follow the specific instructions for cooperative organizations.

- If you have other credits or carryforwards, you must complete Form 3800 to determine your tax liability limit instead of completing Part II of Form 3468.

- Enter the tentative minimum tax on line 11 and adjust any applicable amounts on line 12. If a limit applies to your credit, ensure you carry forward any excess as specified.

- Once all fields are completed, save your changes, and decide on the next action of downloading, printing, or sharing the form as needed.

Complete your investment credit form online to ensure you maximize your potential credits.

Goal of Investment Tax Credit By providing incentives for both individuals and corporations to invest in specific large-scale projects, it is hoped that the money spent will result in a surge of economic growth.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.