Loading

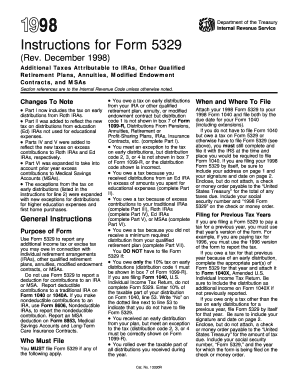

Get 1998 Instructions 5329. Additional Taxes Attributable To Iras, Other Qualified Retirement Plans

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1998 Instructions 5329. Additional Taxes Attributable To IRAs, Other Qualified Retirement Plans online

This guide provides clear and comprehensive instructions on how to fill out the 1998 Instructions 5329 form online. Following these steps will help you accurately report any additional taxes you may owe related to IRAs and other retirement plans.

Follow the steps to complete the 1998 Instructions 5329 online.

- Click 'Get Form' button to access the 1998 Instructions 5329 online and open it in the editor.

- Review the general instructions on the purpose of the form and check if you are required to file based on your situation. Ensure you understand the exceptions where the form is not necessary.

- Proceed to Part I to report early distributions. Enter the taxable amount of early distributions made to you, ensuring you check the specific details for distributions from an Ed IRA or Roth IRA.

- Follow the instructions for Line 2 in Part I to indicate any distributions that qualify for exceptions to the early withdrawal tax.

- Complete Part II if applicable, detailing any tax on distributions from Ed IRAs not used for educational expenses. Make sure to enter the correct amounts that qualify for exclusion.

- If you have excess contributions, fill out Part III for traditional IRAs, Part IV for Roth IRAs, and Part V for Ed IRAs, entering the relevant excess contribution amounts.

- For Medical Savings Accounts, complete Part VI by detailing any excess contributions, again entering relevant amounts.

- Finally, complete Part VII if you did not receive the minimum required distribution from your qualified retirement plan, calculating the additional tax owed.

- Review all sections for completeness and accuracy, then save the changes you made to the form.

- Once satisfied with your entries, you may download, print, or share the filled-out form as needed.

Start filling out your 1998 Instructions 5329 online today to ensure accurate reporting of your additional taxes.

Early Distributions Generally, any distribution from your qualified retirement plan, annuity, or modified endowment contract that you receive before you reach age 59½ is an early distribution. The portion of the early distribution that is included in income is subject to an additional 2½% tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.