Loading

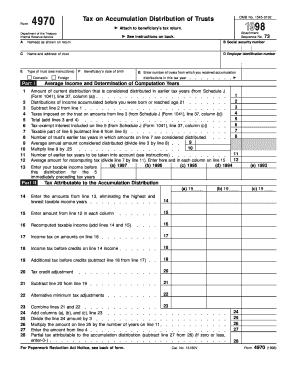

Get Form 4970 Tax On Accumulation Distribution Of Trusts Attach To Beneficiary's Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4970 Tax On Accumulation Distribution Of Trusts Attach To Beneficiary's Tax Return online

Filling out Form 4970 is essential for beneficiaries of trusts that have accumulated income instead of distributing it. This guide will provide you with clear, step-by-step instructions to assist you in completing this form accurately online.

Follow the steps to complete your Form 4970 effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the first section, enter your name as shown on your tax return, along with your Social Security number and the trust's name and address. Also, include the employer identification number and specify whether the trust is domestic or foreign.

- Provide the beneficiary's date of birth and enter the number of trusts from which you received accumulation distributions during the tax year.

- Complete Part I by filling in the current distribution amounts and details regarding income accumulated before significant life events, such as your birth or reaching age 21.

- Calculate the necessary amounts based on the income and taxes imposed on the trust. Make sure to complete lines 1 through 12 accurately.

- Proceed to Part II where you will calculate the tax attributable to the accumulation distribution using the figures obtained from previous lines.

- Enter your taxable income from the five preceding tax years and compute the necessary adjustments such as income tax and alternative minimum tax adjustments.

- Confirm that you have filled out all fields accurately and calculate the final tax attributable to the accumulation distribution.

- Once all fields are complete, save any changes made to your form, and utilize the options available to download, print, or share the form as needed.

Start filling out your Form 4970 online today to ensure your tax obligations are met accurately.

Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities. You should receive a copy of Form 1099-R, or some variation, if you received a distribution of $10 or more from your retirement plan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.