Get 1998 Instructions 1120s (schedule K-1)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1998 Instructions 1120S (Schedule K-1) online

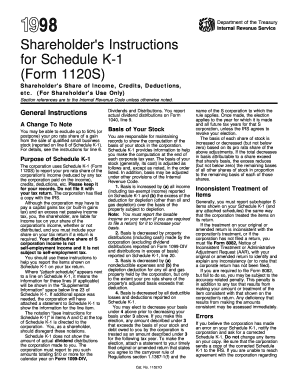

This guide provides a step-by-step approach to filling out the 1998 Instructions 1120S (Schedule K-1) online. It is designed to assist users of all experience levels in correctly completing the form, ensuring accurate reporting of income, credits, and deductions.

Follow the steps to complete the form online.

- Click the ‘Get Form’ button to access the 1998 Instructions 1120S (Schedule K-1) online and open it.

- Review the general instructions provided on the form carefully. Familiarize yourself with the purpose of Schedule K-1, which outlines your share of the corporation's income, credits, and deductions.

- Locate Item C at the top of the form. This section includes specific instructions directed to the corporation regarding tax shelter investments. As a shareholder, focus primarily on the relevant sections for your reporting requirements.

- Proceed to lines 1 through 23, where you will enter amounts reflecting your pro rata share of ordinary income, losses, deductions, and credits. Make sure to check if any limitations apply to your amounts.

- For each line item from 1 to 23, refer to the detailed instructions regarding where to report these amounts on your individual tax return. Pay special attention to passive activity limitations that may affect how losses and credits are utilized.

- Collect supplemental information provided in line 23 for any additional details required for accurate reporting, such as taxes paid on undistributed capital gains.

- Once all necessary fields are filled out correctly, ensure to save your changes. You can download, print, or share the form as needed.

Complete your 1998 Instructions 1120S (Schedule K-1) online today for accurate and compliant tax reporting.

The Schedule K-1 is the form that reports the amounts that are passed through to each party that has an interest in an entity, such as a business partnership or an S corporation. The parties use the information on the K-1 to prepare their separate tax returns. What is a Schedule K-1 Tax Form? - TurboTax Tax Tips & Videos - Intuit intuit.com https://turbotax.intuit.com › tax-tips › small-business-taxes intuit.com https://turbotax.intuit.com › tax-tips › small-business-taxes

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.