Loading

Get 1998 Instructions 6252

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1998 Instructions 6252 online

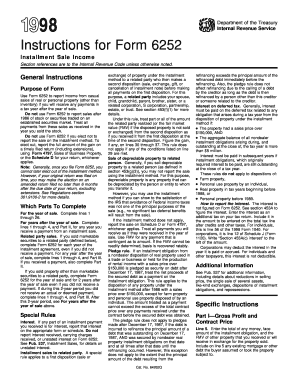

Filling out Form 6252 is essential for reporting income from installment sales of property. This guide provides clear instructions for each section, ensuring you can complete this form accurately and efficiently online.

Follow the steps to complete Form 6252 online

- Press the ‘Get Form’ button to access the form and open it in your preferred online document editor.

- Begin filling out Part I of the form by entering total payments received for the sale in line 5. Include any debts the buyer assumed.

- Provide information about mortgages or debts on line 6 that the buyer took over from you.

- In line 8, detail the original cost and any related expenses incurred when purchasing the property.

- On line 9, list all depreciation or amortization deductions you claimed from the date of purchase to the sale date.

- Fill out line 11 with any selling expenses such as commissions or legal fees.

- Provide any recapture of ordinary income under line 12, completing Form 4797 if necessary.

- If the sold property was your main home, refer to line 15 to determine if any gain can be excluded.

- Move to Part II and enter the gross profit percentage in line 19 even if you did not previously file this form.

- Enter any payments received during the current year in line 21, excluding liabilities assumed by the buyer.

- In line 23, report any prior payments received from the sale before this tax year.

- Complete line 25 with any ordinary income recaptured on section 1252, 1254, or 1255 property.

- For lines 26 through 37, follow instructions based on your transaction details about related party sales or any remaining recapture.

- Once finished, review all information, ensure accuracy, and save your changes. You can download, print, or share the completed form as needed.

Start filling out your 1998 Instructions 6252 online today!

An installment agreement is one where you receive at least one payment after the end of the tax year when the sale occurs. If you realize a gain on an installment sale, you might be able to report part of the gain when you receive each payment. This method of reporting gain is called the installment method.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.